The Spotlight Newsletter

The Spotlight provides insights into economic and market events related to thematic investment opportunities.

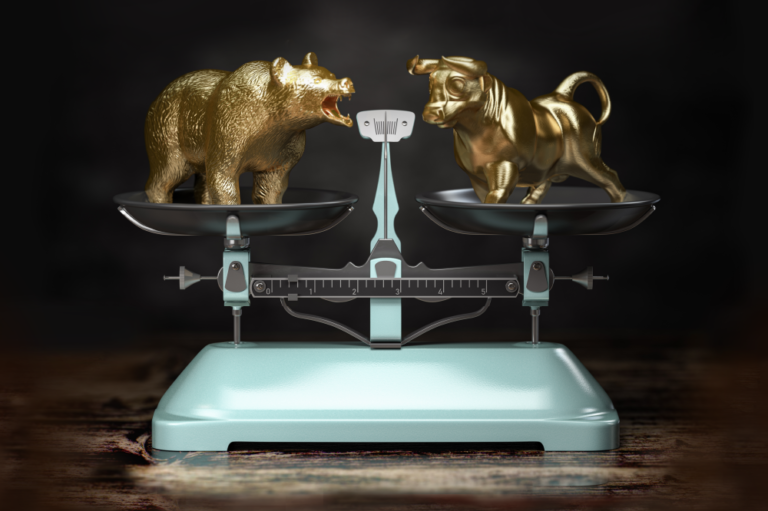

Unveiling Opportunities: Commodities in Today’s Market Landscape

COM

Jan 04, 2024

Moonshot Investors Ditch Mega Caps to Search for the Next Generation of Industry Leaders

MOON

Jul 28, 2023

Equal Weighted NASDAQ-100 Index: What if the Tech Rally Broadens Out?

QQQE

Jul 26, 2023

Work From Home: Here to Stay

WFH

Jul 12, 2023

What Lies Ahead For The Current Tech Rally?

QQQE

Jul 10, 2023

Aim for the Moon with this ETF

MOON

Jun 29, 2023

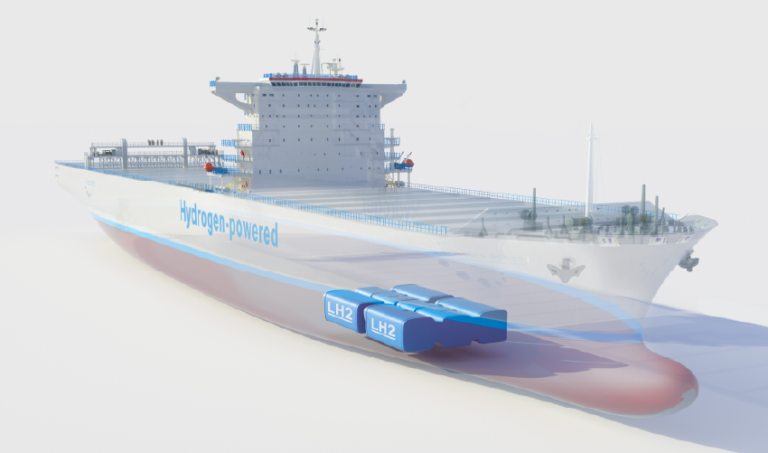

Investing in the Future of the Hydrogen Economy.

HJEN

May 17, 2023

Is Equal Weighting the Next Growth Strategy?

QQQE

Jan 27, 2023

How to Invest in the Future of Clean Energy – Hydrogen

HJEN

Nov 18, 2022

From Pivot to Divot

Nov 16, 2022

Are You Full?

Oct 24, 2022

Back to Basics: Hydrogen

HJEN

Oct 07, 2022

The Gift of Time

Sep 22, 2022

Yielding to the Yield Curve

Sep 06, 2022

High on Hydrogen

HJEN

Sep 02, 2022

Mounting Momentum for MOON

MOON

Aug 30, 2022