Is It Time to Invest in Work From Home Stocks Again? Work From Home ETF (WFH)

Stocks making work from home possible saw positive returns since the advent of the COVID-19 pandemic.1 The WFH ETF since inception has returned 39.40% as of 10/31/2021. Companies have been talking about providing more flexible work solutions. The onset of the pandemic accelerated that dramatically. This is not a short-term phenomenon. So how can investors and traders ride the momentum of the work from home revolution? In this Spotlight installment, we consider two main reasons investor should take a look at the work from home stock segment and the Direxion Work From Home ETF (Ticker: WFH).

- Bureau of Labor Statistics Updates Support Work From Home

- Follow the Money: Investments in Remote Work Productivity and Enterprise Software

Bureau of Labor Statistics Updates Support Work From Home

According to the Bureau of Labor Statistics (BLS), the share of employed people who worked remotely dropped to 11% in October 2021. The number peaked at 35% in May 2020. 11% is the lowest since the COVID-19 pandemic began, highlighting the trend of working from the office, but still well above pre-pandemic levels.

In the financial center of the US, the picture remains mixed and highlights there remains a considerable portion of workers in remote and hybrid work settings and distinctions between BLS data, which includes a considerable range of industries. The Partnership for New York City found that across 188 companies, only 8% of Manhattan office workers are back in the office full time, 54% are fully remote, and the remainder are hybrid.

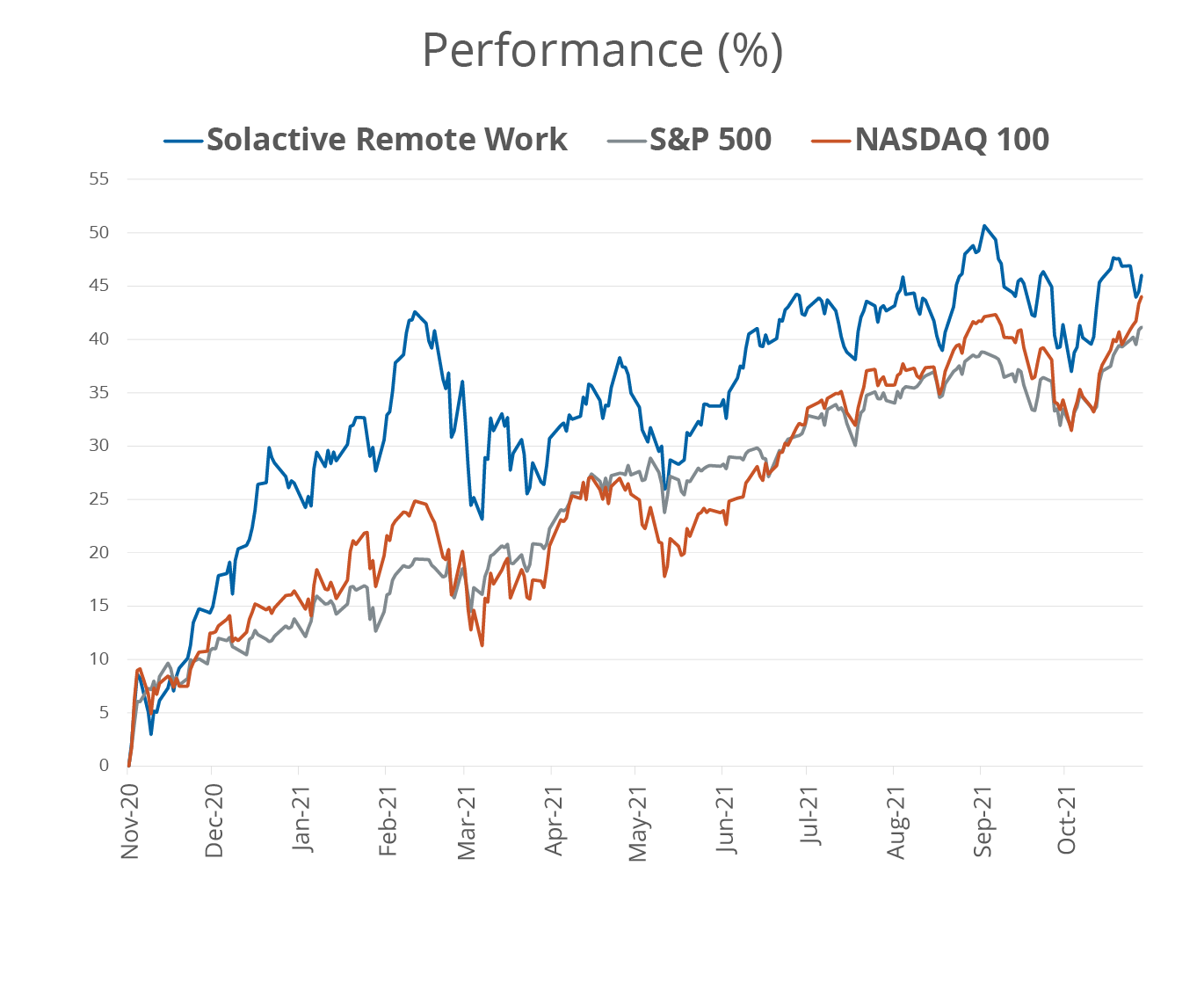

Regardless of the data set one chooses, it is clear more employees are trickling back into the office either full time or in hybrid settings. So, why and how are work from home stocks still outperforming broader benchmarks? In fact, the Direxion Work From Home ETF (WFH) is again approaching its all-time highs.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Returns less than one year are not annualized. For current standardized performance and the most-recent month-end performance and expense, click here.

Work From Home Stocks Still Working

Source: Bloomberg Finance, L.P., as of October 31, 2021. Data represents index total returns. Past performance does not guarantee future results. The S&P 500 Index and the NASDAQ 100 Index are shown for general market comparisons and are not meant to represent the Fund. Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses or sales charges.

Follow the Money: Investments in Remote Work Productivity and Enterprise Software

Simply put, follow the money. The IT investment money that is.

Many companies plan to continue spending on enterprise software as opposed to traditional property, plant, and equipment. There remains a need to support employees wherever they may be located with better tools to collaborate and connect with one another. They also need to ensure data is easily accessible and secure.

The implication is that continued investments in cloud infrastructure, along with security, will continue to be a priority in order to serve a larger remote workforce, as the at-work/at-home balance is unlikely to swing back to pre-COVID levels.

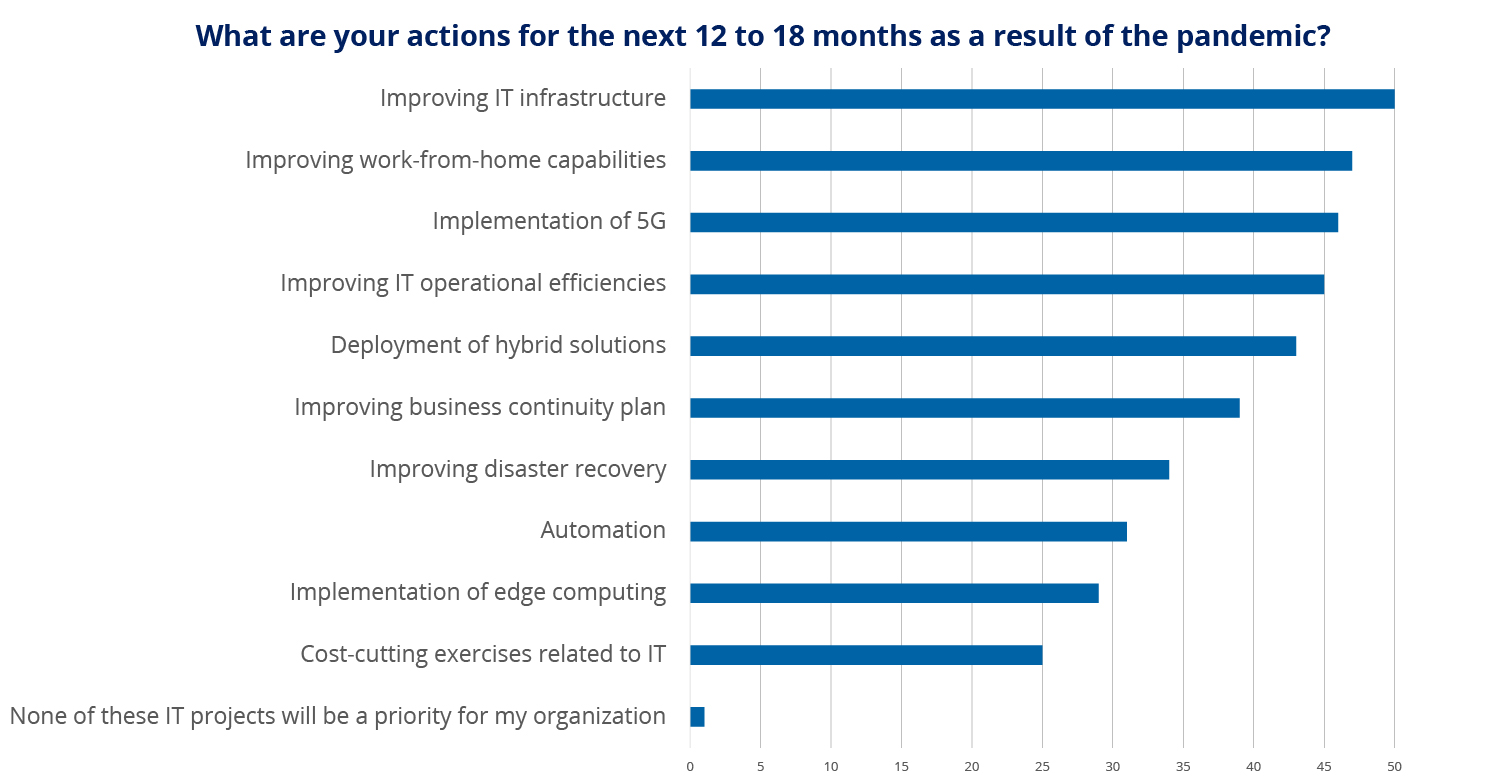

In Nutanix’s third annual Enterprise Cloud Index survey titled “Enterprises Embark on Hybrid IT Journey”, 50% of information technology (IT) decision makers noted improving their IT infrastructure is a top priority in response to the COVID-19 pandemic. Over 40% indicated the need to improve work from home capabilities, implement 5G, and improve operational efficiencies.

Work From Home Economy: Companies Plan to Invest in IT

Source: Nutanix, Inc., Vanson Bourne. November 2020.

The themes in the Solactive Remote Work Index capture these corporate trends at the employee and enterprise level. They include four distinct pillars what support the work from home stock sectors: cloud technology, cyber security, online project and document management, and remote communication. At the narrow industry level, over 60% of WFH is application and systems software.

Application and Systems Software Represent over 60% of WFH

| GICS* Sub-Industry | Weight (%) |

|---|---|

| Application Software | 32.52 |

| Systems Software | 29.58 |

| Interactive Media & Services | 7.13 |

| Communications Equipment | 6.55 |

| Semiconductors | 5.62 |

| Internet & Direct Marketing Retail | 4.9 |

| Technology Hardware, Storage & Peripherals | 4.57 |

| Internet Services & Infrastructure | 4.45 |

| Wireless Telecommunication Services | 2.39 |

| IT Consulting & Other Services | 2.29 |

As noted in July 2021, the return to offices may not entail the end of potential outperformance for the WFH ETF. While pandemic winners, such as Peloton Interactive, Inc. (PTON), Pinterest, Inc. (PINS), and Spotify Technology S.A. (SPOT) are all down on the year, true work from home stocks are outperforming.2 These 40 stocks are all transforming work and helping powering the future of work. For the WFH top ten holdings click here.

1 Stocks making work from home possible are defined as the 40 stocks in the Solactive Remote Work Index, which the Direxion Work From Home ETF (WFH).

2 True work from home stocks as defined by the stocks in the Solactive Remote Work Index. PTON, PINS, and SPOT are not components in the Direxion Work From Home ETF (WFH).

Definitions

- *GICS: Global Industry Classification Standard is a method for assigning companies to a specific economic sector and industry group that best defines its business operations.

- Solactive Remote Work Index: composed of companies offering key technological infrastructure and services in the fields of Cloud Technologies, Cybersecurity, Online Project and Document Management, and Remote Communications. This set of companies are possibly set to be among the one that profit the most from the transition towards the remote workplace.

- S&P500 Index: The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices.

- NASDAQ 100 Index: The Nasdaq-100 is a stock market index made up of 102 equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock market. It is a modified capitalization-weighted index.