Moonshot Innovators: Out with the Old, In with the New.

DAVID MAZZA, MANAGING DIRECTOR, HEAD OF PRODUCT & INKOO KANG, VICE PRESIDENT

The Direxion Moonshot Innovators ETF gained 14.55%/14.62%* (price return/NAV return) in the first half of 2021[1], outpacing the S&P 500, Nasdaq-100 and Russell 2000 Indexes during that period.

LiDAR, AUTONOMOUS VEHICLES AND WEARABLES

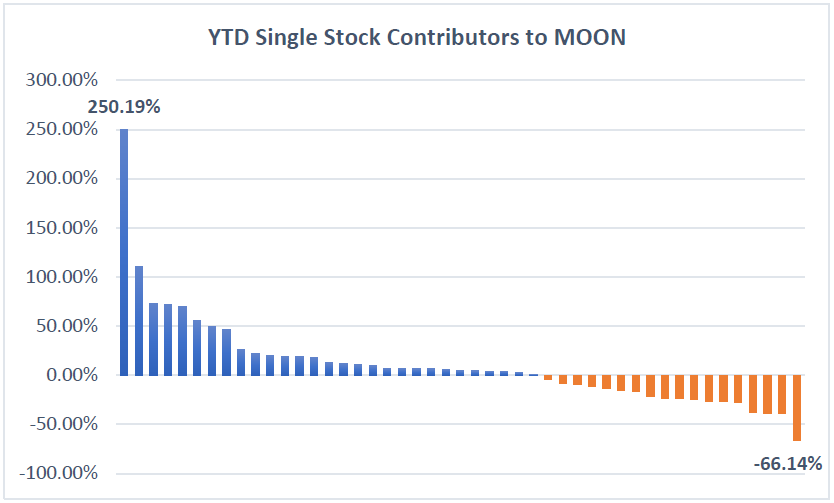

During that first half of 2021, we witnessed some real moonshot potential come to fruition in both single names and across broader themes. Back in February, MicroVision (NASDAQ: MVIS) announced that the first wave of samples of its first generation, long-range LiDAR sensors were almost ready. The potential implications of their groundbreaking technology across the EV and autonomous vehicle space was quickly recognized by the marketplace, and MVIS delivered 250% gains through June 18. Vuzix (NASDAQ: VUZI) and Energy Recovery Inc. (NASDAQ: ERII) were also standout names through this period, as investors saw remarkable innovation being delivered by these firms for wearable technologies and fresh water solutions.

PROGRESS TOWARDS THE IMPOSSIBLE SOMETIMES RESULTS IN FAILURE

On the flip side, not all moonshots reach their full potential. In April, Adverum Biotechnologies (NASDAQ: ADVM) cited apparent side effects of decreased vision in a patient in trials for its lead gene therapy candidate, ADVM-022, for diabetic macular edema (DME). Soon thereafter in July, Adverum announced that they will no longer advance that candidate for treatment in DME due to dose-limiting toxicity, and the stock traded down to a 52-week low below $3 a share. Less than ideal outcomes are common in the genetic engineering space, but we continue to press forward for solving for some of the most audacious and unmet needs in human health.

BLOCKCHAIN, DRONES AND GENETIC ENGINEERING

In broader thematic exposures, investors continued to place premiums and recognize the innovation happening in the 3D Printing, Smart Grids, Enterprise Collaboration and Distributed Ledger (blockchain) sub-themes. The average performance for stocks representing those sub-themes in MOON delivered returns of 47.7%, 46.8%, 22.3%, and 15.4%, respectively. The Drones and Genetic Engineering sub-themes were the notable laggards, with negative average stock returns of 7.5% and 9.5%, respectively.

MOONSHOT PERFORMERS DELIVERED OUTSIZED CONTRIBUTIONS FOR MOON IN THE FIRST HALF OF 2021

Source: Bloomberg, L.P. as of June 18, 2021.

MOON seeks to track the performance of the S&P Kensho Moonshots Index, which offers exposure to what the index measures as the 50 most innovative early stage US-listed companies pursuing innovation and having the potential to disrupt existing technologies and/or industries. These 50 companies selected for inclusion are deemed to have the highest “early-stage composite innovation scores” spanning multiple themes. A company’s “allocation to innovation” and “innovation sentiment” comprised the composite score.

NEW MOON RISING

While the index added 23 companies, and removed 20, the underlying thematic allocations and exposures remained relatively consistent. That said, new names across the Internet Infrastructure, Alternative Finance, Clean Technology, Future Payments, Smart Borders and Nanotechnology themes have added more breadth to the exposure to innovation and disruption that the MOON ETF is keen on delivering. This level of turnover during the annual reconstitution is consistent with expectations.

MOON ADDED 23 COMPANIES & REMOVED 20

| ADDITIONS | Ticker | Thematic Classification |

| Dropbox Inc | DBX | Enterprise Collaboration |

| ChargePoint Holdings Inc | CHPT | Smart Grids |

| CRISPR Therapeutics AG | CRSP | Genetic Engineering |

| Asana Inc | ASAN | Enterprise Collaboration |

| Luminar Technologies Inc | LAZR | Autonomous Vehicles |

| Nikola Corp | NKLA | Electric Vehicles |

| BigCommerce Holdings Inc | BIGC | Internet Infrastructure |

| Desktop Metal Inc | DM | 3D Printing |

| Xperi Holding Corp | XPER | Autonomous Vehicles |

| Velodyne Lidar Inc | VLDR | Autonomous Vehicles |

| LendingClub Corp | LC | Alternative Finance |

| Agilysys Inc | AGYS | Future Payments |

| Romeo Power Inc | RMO | Electric Vehicles |

| 908 Devices Inc | MASS | Smart Borders |

| Eos Energy Enterprises Inc | EOSE | Cleantech |

| Arcturus Therapeutics Holdings Inc | ARCT | Genetic Engineering |

| Asensus Surgical Inc | ASXC | Robotics |

| Sohu.com Ltd | SOHU | Digital Communities |

| Ebang International Holdings Inc | EBON | Alternative Finance |

| ElectraMeccanica Vehicles Corp | SOLO | Electric Vehicles |

| BIT Mining Ltd | BTCM | Distributed Ledger |

| ProQR Therapeutics NV | PRQR | Genetic Engineering |

| Super League Gaming Inc | SLGG | Digital Communities |

| DELETES | Ticker | Thematic Classification |

| ExOne Co/The | XONE | 3D Printing |

| Vir Biotechnology Inc | VIR | Genetic Engineering |

| A10 Networks Inc | ATEN | Cyber Security |

| Lyft Inc | LYFT | Advanced Transport Systems |

| Wix.com Ltd | WIX | Internet Services & Infrastructure |

| Zynga Inc | ZNGA | Digital Communities |

| Tenable Holdings Inc | TENB | Cyber Security |

| Plug Power Inc | PLUG | Clean Technology |

| FuelCell Energy Inc | FCEL | Clean Technology |

| Veoneer Inc | VNE | Autonomous Vehicles |

| Fate Therapeutics Inc | FATE | Genetic Engineering |

| Bluebird Bio Inc | BLUE | Genetic Engineering |

| American Superconductor Corp | AMSC | Clean Technology |

| Homology Medicines Inc | FIXX | Genetic Engineering |

| Ooma Inc | OOMA | Enterprise Collaboration |

| uniQure NV | QURE | Genetic Engineering |

| Immersion Corp | IMMR | Wearables |

| Ribbon Communications Inc | RBBN | Enterprise Collaboration |

| VirnetX Holding Corp | VHC | Cyber Security |

| Adverum Biotechnologies Inc | ADVM | Genetic Engineering |

Source: Bloomberg FInance, L.P. as of June 18, 2021.

Thematically speaking, the Electric Vehicles sub-theme saw the largest increase, moving from 0% to over 5% with Nikola Corp. (NASDAQ: NKLA) being the most notable name added to the basket, along with Romeo Power Inc. (NYSE: RMO) and ElectraMeccanica Vehicles Corp. (NASDAQ: SOLO). Exposure to Autonomous Vehicles saw an uptick through the form of “systems and solutions” names with some interesting new additions in Xperi Holding Corp. (NASDAQ: XPER) and Velodyne Lidar Inc. (NASDAQ: VLDR). In the Genetic Engineering sub-theme, CRSPR Therapeutics (NASDAQ: CRSP) was the most notable company to be added, as overall exposure to the theme decreased slightly with net deletions. As noted earlier, Alternative Finance, Clean Technology, Future Payments, Smart Borders and Nanotechnology are entirely new themes included in the portfolio, comprising nearly 15% of the portfolio.

Through the modified equal weighted approach, names such as Microvision, Inc. and Vuzix Corp. decreased in weight after their remarkable gains in the first half of 2021. Overall, Cyber Security exposure declined the most following the rebalance.

MOON’S THEMATIC ALLOCATIONS REMAINED RELATIVELY CONSISTENT

| Thematic Classification | Post-Rebalance | Pre-Rebalance |

| Genetic Engineering | 13.56% | 15.56% |

| Cyber Security | 10.45% | 16.04% |

| Autonomous Vehicles | 7.92% | 3.77% |

| Enterprise Collaboration | 7.11% | 4.20% |

| Drones | 5.88% | 4.95% |

| Digital Communities | 5.88% | 4.37% |

| Distributed Ledger | 5.80% | 3.15% |

| Electric Vehicles | 5.49% | 0.00% |

| Robotics | 4.97% | 3.32% |

| Internet Infrastructure | 4.60% | 0.00% |

| Smart Grids | 4.47% | 1.39% |

| Alternative Finance | 4.31% | 0.00% |

| Smart Buildings | 4.04% | 2.07% |

| Cleantech | 3.90% | 0.00% |

| 3D Printing | 3.87% | 5.08% |

| Space | 2.10% | 2.04% |

| Future Payments | 2.02% | 0.00% |

| Smart Borders | 1.88% | 0.00% |

| Nanotechnology | 1.74% | 0.00% |

Source: Bloomberg Finance, L.P. as of June 18, 2021.

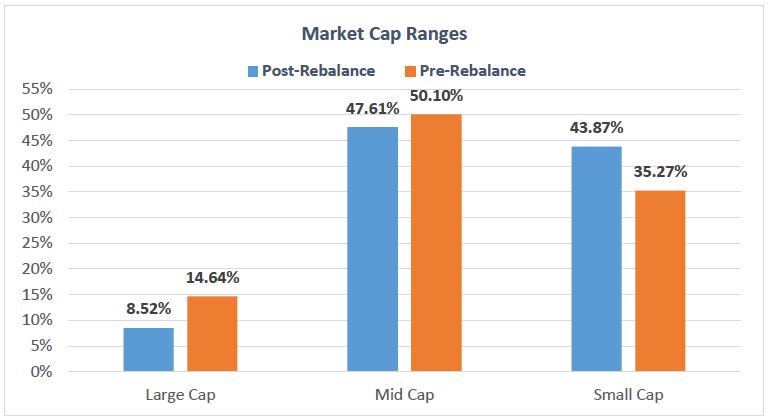

As expected with an investment strategy that tilts toward early stage innovation, the reconstitution drove a decrease in large caps and increased exposure to small and mid-cap allocations. Large caps now represent less than 9% of the portfolio. Of course, this may increase should the current firms increase in market value, which aligns with the strategy’s systematic approach to buying low and selling high.

MARKET CAP MOVED LOWER

Source: Bloomberg Finance, L.P., as of June 18, 2021.

Over the next quarter, MOON’s performance may be influenced by macro factors, such as interest rates, but the strategy’s tilt toward disruptive innovation remains attractive to investors looking to diversify away the mega caps continuing to dominate many indexes and even active funds. In short, MOON looks and behaves quite differently than many other offerings in today’s investment landscape.

MOON TOP 10 HOLDINGS

| Name | Ticker | GICS Sub‐Industry | Thematic Classification | Market Cap ($, M) | Weight |

| Asana Inc | ASAN | Application Software | Enterprise Collaboration | 9,748 | 2.97% |

| LendingClub Corp | LC | Consumer Finance | Alternative Finance | 1,847 | 2.38% |

| ChargePoint Holdings Inc | CHPT | Electrical Components & Equipment | Smart Grids | 9,987 | 2.36% |

| MongoDB Inc | MDB | Internet Services & Infrastruc | Internet Infrastructure | 23,613 | 2.36% |

| Varonis Systems Inc | VRNS | Systems Software | Cyber Security | 6,022 | 2.33% |

| BigCommerce Holdings Inc | BIGC | Internet Services & Infrastruc | Internet Infrastructure | 4,560 | 2.24% |

| CRISPR Therapeutics AG | CRSP | Biotechnology | Genetic Engineering | 9,821 | 2.21% |

| ProQR Therapeutics NV | PRQR | Biotechnology | Genetic Engineering | 454 | 2.18% |

| Asensus Surgical Inc | ASXC | Health Care Equipment | Robotics | 718 | 2.16% |

| Silicon Laboratories Inc | SLAB | Semiconductors | Smart Buildings | 6,323 | 2.16% |

Source: Bloomberg Finance, L.P. as of June 18, 2021.

[1] Data through June 18, 2021.

* The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns for performance under one year are cumulative, not annualized. Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes. For additional information, see the fund’s prospectus. For standardized and month-end performance, click here.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-301-9214 or visit our website at direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

The “S&P Kensho Moonshots Index” is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Rafferty Asset Management, LLC (“Rafferty”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Rafferty. Rafferty’s ETFs are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P Kensho Moonshots Index.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Shares ETF Risks – Investing involves risk including possible loss of principal. There is no guarantee the investment strategy will be successful. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from competitors with lower production costs. ADRs are issued by non-U.S. companies and are subject to various foreign investment risks including but not limited to the risk that the currency in the issuing company’s country will drop relative to the U.S. dollar, that politics or regime changes in the issuing company’s country will undermine exchange rates or destabilize the company and its earnings. Additional risks of the Fund include, but are not limited to, Index Correlation/ Tracking Risk, Index Strategy Risk, Market Disruption Risk, American Depositary Receipts Risk and risks associated with the market capitalizations of the securities in which the Fund may invest. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Distributor: Foreside Fund Services, LLC.