Dictionary.com defines “fad” as a “temporary fashion, notion, manner of conduct, etc., especially one followed enthusiastically by a group.” Some naysayers continue to claim remote work is indeed a fad, and ultimate adoption will be fleeting. Building on the technological gains made in the third industrial revolution, remote work is a key byproduct of the fourth industrial revolution, which will continue to define the 21st century. I have even heard Yahoo used as an example of why it does not work. I am sorry, but that is akin to saying there may never be a market for smart watches after the Microsoft SPOT Watch failed to take off in 2004. Ultimately, time will tell, but because of this overly skeptical perspective, investors have an opportunity to capitalize on this trend, which remains in the early stage of a becoming an established, long-term theme.

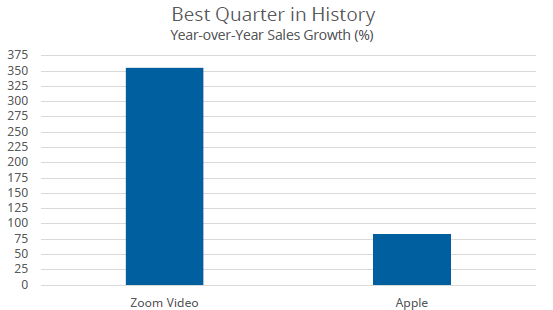

Let us dive into Zoom Video’s (ZM) latest numbers to illustrate this point. Compared to $5.5 million last year, Zoom’s quarterly profit of $186 million was nearly 3,300% larger. Its quarterly sales of $663 million jumped 355% year-over-year. In the entire 2019 fiscal year, the company did sales of $331 million. To put it bluntly, this growth blew away analyst expectations. Maybe more importantly, the company raised its full year growth forecast, suggesting their growth trajectory still has room to run.

For some context, Apple’s best quarter was in March 2011 when they delivered 83% year-over-year sales growth. I am not implying Zoom will overtake Apple as one of the world’s leading companies in the next year, or even ever, but rather making the point of Zoom’s quarter being truly exceptional and their product offering seeing robust demand.

In a world where growth is hard to find, it may be less of surprise investors were so pleased, as shares jumped over 40% on the day after they released quarterly numbers. (I know the rest of the week was not so rosy, but I will get to that.)

ZOOM VIDEO’S SALES GROWTH WAS REMARKABLE

Source:Bloomberg Finance, L.P., as of September 1, 2020.

While Zoom blew away expectations, other recent reporters include CrowdStrike (CRWD) and DocuSign (DOCU). CRWD’s second quarter revenue of $199 million beat the highest quarterly estimate and they raised 2021 guidance. DOCU also beat the highest street estimate, reporting second quarter revenue of $342 million, rising 45% year over year. They also raised guidance for the third quarter, and full year, as their core business of digitizing agreements accelerated.

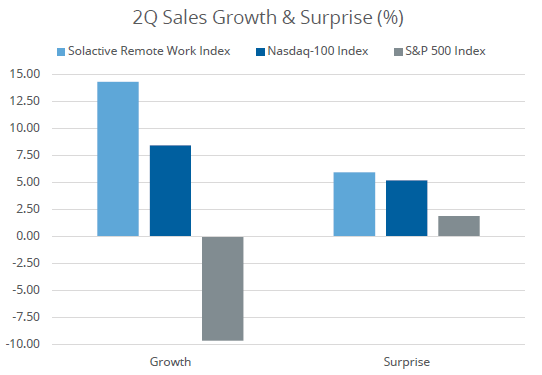

With all companies reporting, the stocks in the Solactive Remote Work Index generated an impressive 14.3% sales growth in the most recent quarter. This is better than the relatively strong 8.4% from Nasdaq-100 Index, and much better than the -9.6% of the S&P 500. With surprises of nearly 6%, they also beat analyst expectations more than both of the broader indexes did.

REMOTE WORK STOCKS HAVE SURPRISED TO THE UPSIDE

Source: Bloomberg Finance, L.P., as of September 8, 2020. Past performance is not inactive of future results. One cannot invest directly in an index.

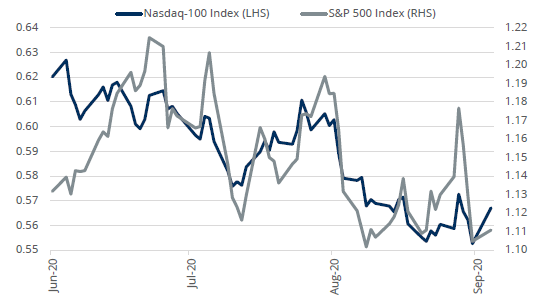

Okay, so the growth is there and it may even strengthen due to the macroeconomic environment. However, have investors already caught on to these positives and bid up share prices too aggressively making any future returns muted?

At 2.79 times sales, remote work stocks may not be inexpensive on an absolute basis, but they remain attractively valued compared to the Nasdaq-100. In fact, over the last three months, their attractiveness has increased. While they trade at higher multiples to the S&P 500, they are trending downwards on a relative basis as well.

THE RELATIVE VALUATIONS OF REMOTE WORK STOCKS HAVE BECOME MORE ATTRACTIVE

Source: Source: Bloomberg Finance, L.P., as of September 8, 2020. Past performance is not indicative of future results. One cannot invest directly in an index.

Some may wish for the world to return to a so-called normal, but it pays to understand when disruption is afoot and lean into it. I would agree investors should recognize the world has already changed, and will continue to change, and so have the companies that will benefit in the future. While not often easy to experience, change itself is neither good nor bad.

Rather, it is what you make of it. While the path to get there may not be linear, the opportunities may be exponential, especially for companies at the forefront of making our working lives more efficient and productive.

For the funds’ standardized and most recent month end performance click here (www.direxion.com/etfs)

WFH Index Top 10 Holdings (as of 9/30/2020)

| Zoom Video Communications | 3 |

| America Movil | 2.75 |

| Elastic | 2.74 |

| Oracle | 2.73 |

| Xerox | 2.71 |

| Alibaba Group | 2.68 |

| Cincinnati Bell | 2.68 |

| Vmware | 2.64 |

| Broadcom Limited | 2.63 |

| Crowdstrike Holdings | 2.61 |

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-301-9214 or visit our website at direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Market Disruptions Resulting from COVID-19. TThe outbreak of COVID-19 has negatively affected the worldwide economy, individual countries, individual companies and the market in general. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to the Fund.

CUSIP Identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by Standard and Poor’s Financial Services, LLC, and are not for use or dissemination in any manner that would serve as a substitute for a CUSIP service. The CUSIP Database, ©2011 American Bankers Association. “CUSIP” is a registered trademark of the American Bankers Association.

Solactive AG is not a sponsor of, or in any way affiliated with, the Direxion Work From Home ETF.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Shares ETF Risks -Investing involves risk including possible loss of principal. There is no guarantee the investment strategy will be successful. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from competitors with lower production costs. ADRs are issued by non-U.S. companies and are subject to various foreign investment risks including but not limited to the risk that the currency in the issuing company’s country will drop relative to the U.S. dollar, that politics or regime changes in the issuing company’s country will undermine exchange rates or destabilize the company and its earnings. Additional risks of the Fund include, but are not limited to, Index Correlation/ Tracking Risk, Index Strategy Risk, Market Disruption Risk, American Depositary Receipts Risk and risks associated with the market capitalizations of the securities in which the Fund may invest. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Distributor: Foreside Fund Services, LLC.