Unlocking the Insights of Active Traders

Direxion’s Trader Sentiment Survey Reveals Key Trends

Our Trader Sentiment Survey delves deep into their preferences and behaviors. According to the latest Trader Sentiment Survey conducted by the Harris Poll on behalf of Direxion, here are the key takeaways:

Tools for Diverse Strategies

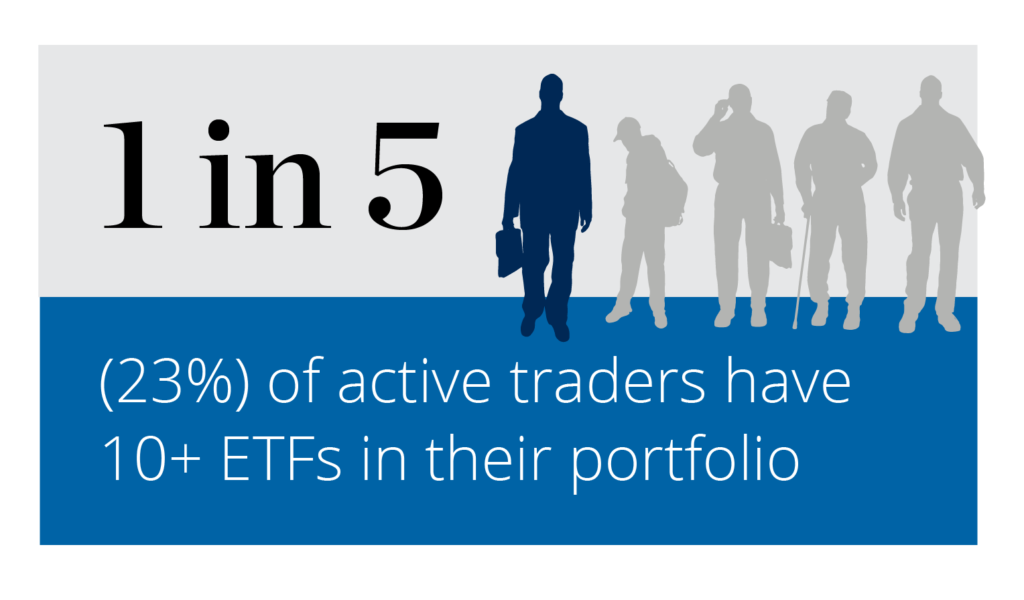

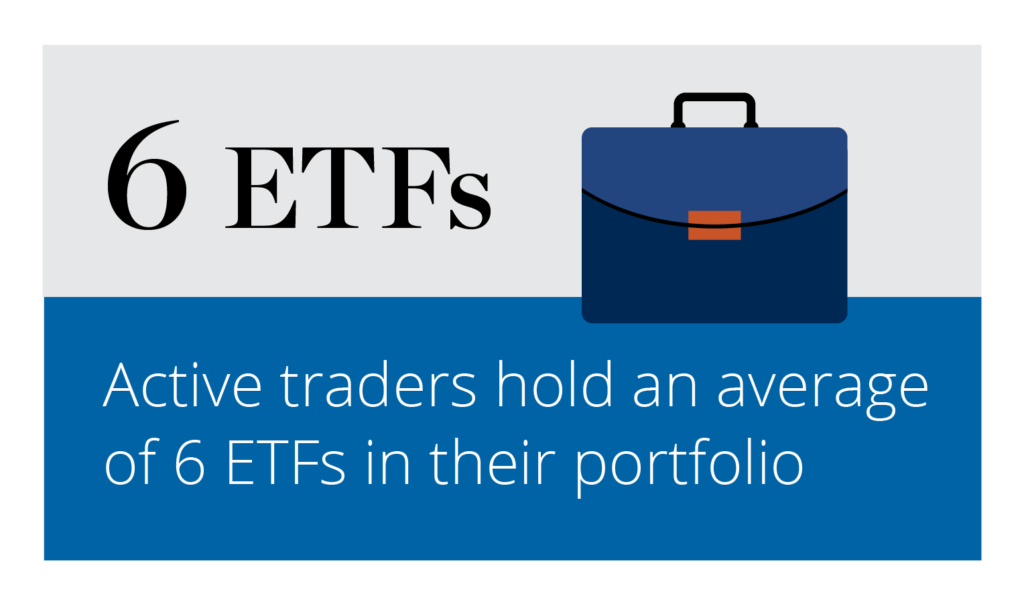

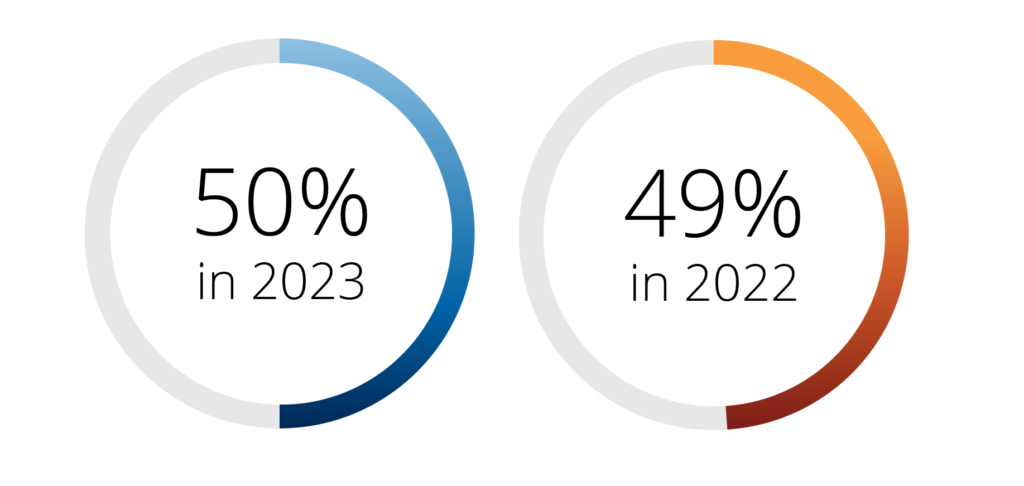

Traders harness the power of ETFs to navigate markets. In 2023, 50% of active traders hold ETFs in their portfolios, with 23% holding 10 or more. Notably, 42% increased their ETF allocation over the past year, possibly emphasizing their appeal in diverse portfolios.

Active traders report holding ETFs in their portfolio

Generational Dynamics

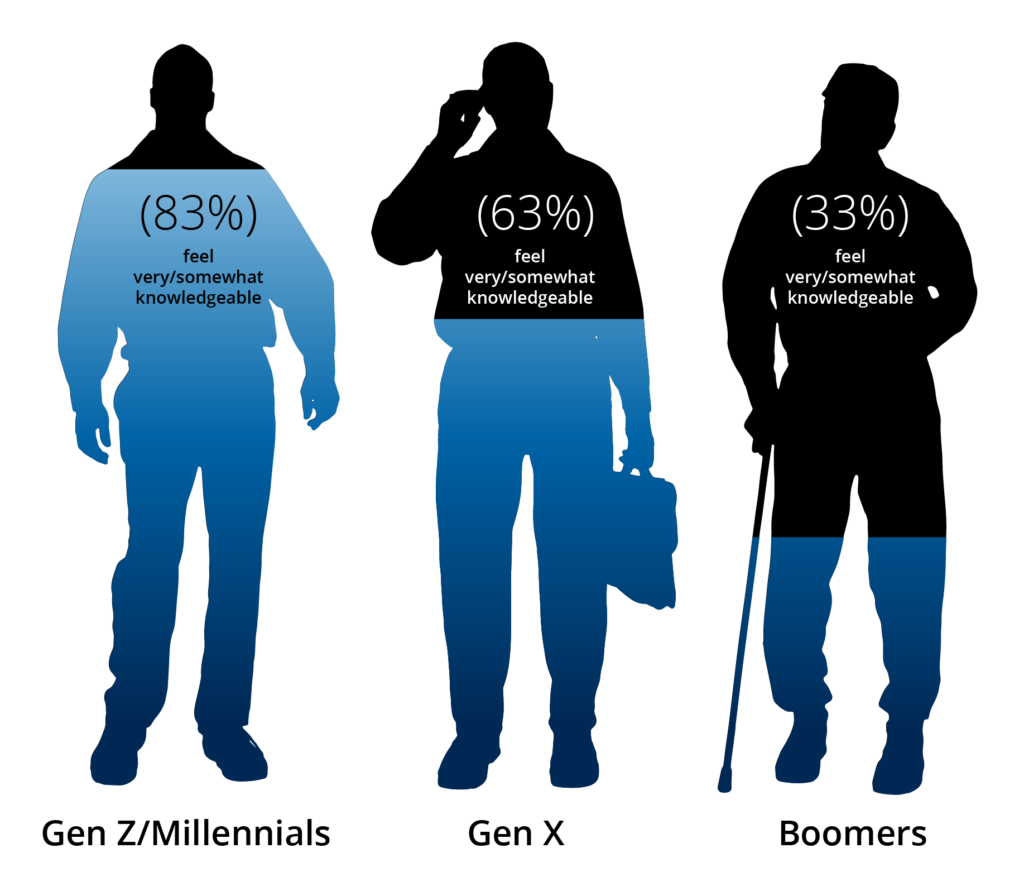

A clear generational shift emerges, highlighting Gen Z/Millennials' expertise in leveraged ETFs. Younger and high-net-worth traders value ETFs for their ability to meet investment goals, demonstrating a distinct preference for non-traditional trading vehicles. The proportion of active traders who feel very/somewhat knowledgeable about leveraged/inverse ETFs increases significantly amongst Gen Z/Millennials (83%), compared to Gen X (63%) and Boomers+ (33%).

Across generations, traders are showcasing active interest and control in their investment decisions. They not only understand leveraged & inverse ETFs, but also see the value of diversification through non-traditional trading vehicles. At Direxion, we're committed to supporting traders of all generations on their journey to informed decision-making, ensuring they have the educational tools and materials they need to succeed.Andy O'Rourke, Direxion Chief Marketing Officer

The proportion of active traders who feel very/somewhat knowledgeable about leveraged/inverse ETFs

Empowered Decision-Making

Engaged traders, well-versed in ETFs, value control and personalized strategies. Active traders are using ETFs to take control of their investment decisions in a short-term, active way. 81% of active traders who are very/somewhat knowledgeable and engaged about ETFs and have 5+ ETFs in their portfolio state that they benefit from having autonomy over their investment decisions.

Active traders care about being in control with 81% stating a benefit they get from being an active trader is being in charge of their decisions and/or making trades when it suits them

Market Opportunism

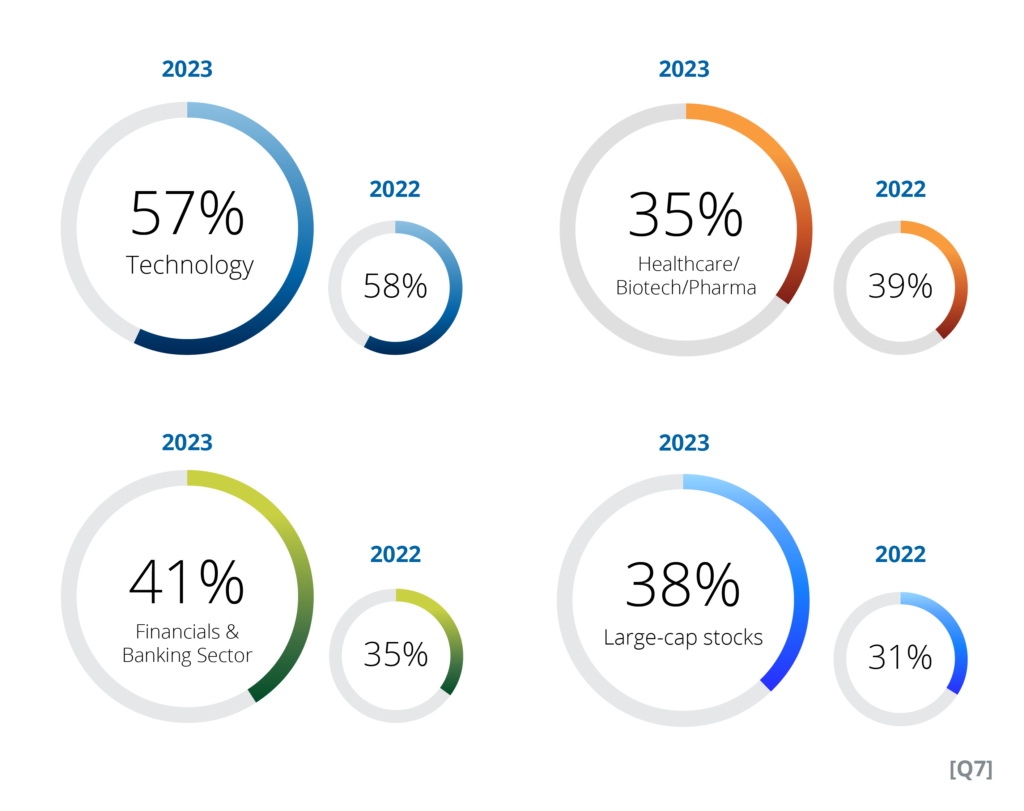

In a low volatility environment*, active traders seek income and excess returns, making the technology sector a beacon of opportunity. 57% view technology, and 41% view Financials & Banking as the prime sector for active trading in the next six months, underscoring their adaptability in ever-changing markets. The next most popular choices are Energy, Large-Caps stocks, and Healthcare/Biotech/Pharma, respectively).

Active traders favor Technology (57%) and Financials & Banking (45%) as the top ETF sectors for maximizing value in the next 12 months

Active investors believe these sectors will offer the most opportunity for active trading in the next six months

AI Integration

Active traders are embracing technology not only as an investment opportunity, with 60% using any AI/robo-advisors and 71% planning to start or increase their utilization. Beyond mere investment, they seek AI and Technology's aid in shaping informed trading decisions, showcasing their forward-thinking approach.

Active traders state they currently use or have used AI/robo-advisors in their investment planning, strategy, or execution (60%)

71% of active traders plan to start/increase their use of AI/robo-advisor tools in the next two years

Over the past year, active traders have increasingly turned their attention to the AI and Technology markets, understanding the transformative potential that these industries offer. For the first three quarters of 2023, the dollar value trading in our four flagship technology related leveraged & inverse ETFs (TECL, TECS, SOXL, SOXS) represented over a third (36%) of the overall value traded in the entire suite of funds.”Ed Egilinsky, Managing Director at Direxion

Steady ETF Adoption

The survey indicates consistency in ETF usage, with 50% of traders holding ETFs in 2023. While 45% hold general ETFs, 15% hold leveraged/inverse ETFs, echoing the trends observed in 2022.

Direxion's Trader Sentiment Survey paints a comprehensive picture of active traders, highlighting their adaptability, informed decisions, and keen interest in emerging technologies. As the market landscape evolves, these insights serve as a compass, guiding both traders and investors towards more informed, empowered choices.

Stay tuned for more insights from Direxion, where market understanding meets innovative investment and trading tools.

* Source: Bloomberg Data. 1/1/23-9/30/23. Past performance is no guarantee of future results

Survey Methodology: The research was conducted online in the U.S. by The Harris Poll on behalf of Direxion among 500 U.S. Adults aged 18 years or older, with at least $25,000 in investable assets. The survey was conducted from 19th July to 7th August. Data are weighted where necessary by age, gender, race/ethnicity, region, education, marital status, household size, employment, household income, investable assets, and propensity to be online to bring them in line with their actual proportions in the population. Respondents for this survey were selected from among those who have agreed to participate in our surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within + 5.55 percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest. All sample surveys and polls, whether or not they use probability sampling, are subject to other multiple sources of error which are most often not possible to quantify or estimate, including, but not limited to coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments.

For complete survey methodology, including weighting variables and subgroup sample sizes, please contact [email protected].

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or click here. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Leveraged and Inverse ETFs pursue daily leveraged investment objectives, which means they are riskier than alternatives which do not use leverage. They seek daily goals and should not be expected to track the underlying index over periods longer than one day. They are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk and who actively manage their investments.

Direxion Shares ETF Risks - An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non-diversified and include risks associated with concentration that results from an ETF’s investments in a particular industry, sector or company, which can increase volatility. The leveraged and inverse ETF utilize derivatives, such as futures contracts and swaps which are subject to market risks that may cause their price to fluctuate over time. The leveraged and inverse ETFs do not attempt to, and should not be expected to, provide returns which are a multiple of the return of their respective index or underlying security for periods other than a single day. The leveraged and inverse ETFs may also subject to leverage, correlation, daily compounding, market volatility and risks specific to an industry, sector or company. The non-leveraged ETFs are subject to certain risks, including imperfect index correlation and market price variance, which may decrease performance. The non-leveraged ETFs may invest in a relatively small number of issuers and, as a result, be subject to greater risk of loss with respect to its portfolio securities. The non-leveraged ETFs may experience greater fluctuation in its net asset value as compared to other investments. The non-leveraged ETFs may be appropriate for investors with a long-term investment time horizon, who primarily seek capital growth, and who are able to tolerate periods of prolonged price declines. Please read each ETF’s prospectus for a more complete description of the investment risks.

Distributor: Foreside Fund Services, LLC.