Some investors are okay with slow and steady returns. But others—knowing that boring isn’t usually the way to hit a home run—are willing to take on more risk in search of potential outperformance. These more adventurous investors may want to consider the Direxion Moonshot Innovators ETF (MOON). At a time of rapid technological change, MOON offers traders a way to consider investing in this space.

Source: StockCharts.Com, June 12, 2023

Candlestick charts display the high and low (the stick) and the open and close price (the body) of a security for a specific period. If the body is filled, it means the close was lower than the open. If the body is empty, it means the close was higher than the open.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For the most recent month-end performance go to Direxion.com. For standardized performance click here.

A rules-based, modified-equal weighted index ETF, MOON seeks investment results (net of fees and expenses) that track the performance of the S&P Kensho Moonshots Index.*

The index seeks to capture the 50 most innovative US companies at the forefront of changing our lives today, and tomorrow, by identifying the companies both pursuing innovation and having the potential to disrupt existing technologies and/or industries.

The benchmark arrives at an early-stage innovation score by ranking companies by the percentage of resources they dedicate to innovation, as well as the degree to which they publicly stress innovation in annual filings. This latter aspect relates to sentiment, which we all know can play a big role in driving stock prices. Indeed, it’s no coincidence that mentions of artificial intelligence (AI) skyrocketed in first quarter earnings calls and we believe the trend will likely continue.

Forecasts are inherently limited and should not be relied upon when making investment decisions. There is no guarantee the sector will experience projected growth. In addition, there is no guarantee it will translate to positive fund performance.

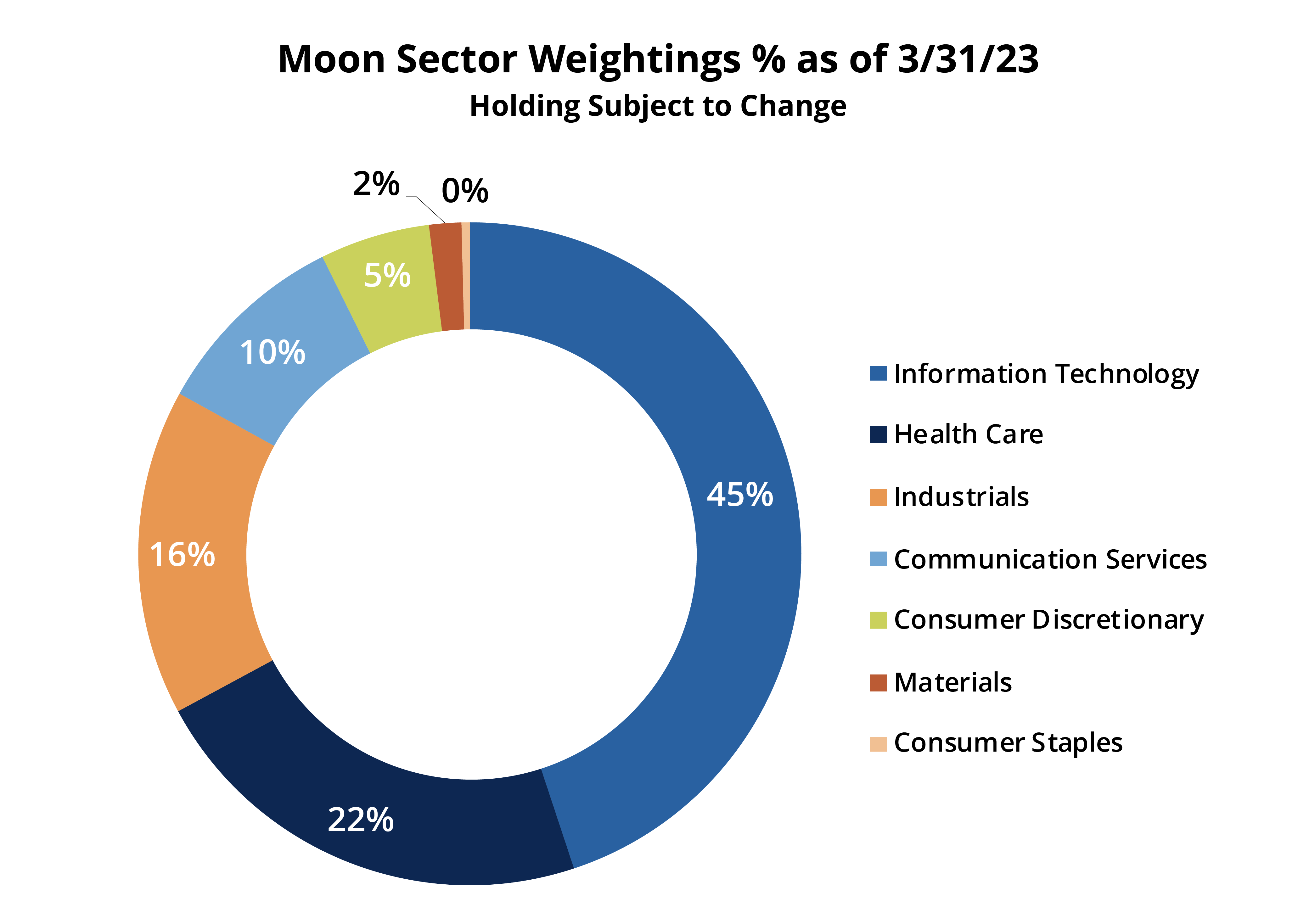

It won’t surprise anyone that technology companies comprise a big share of MOON. Indeed, as of March 31, information technology firms comprised 45% of the ETF’s total market capitalization. But MOON is more than just a tech ETF: Nearly 22% of the fund’s value is in healthcare, and another 16% or so is in Industrials. Tech may be synonymous with innovation, but innovation isn’t limited to tech.

A Look Under the Hood: Three Companies Aiming for Liftoff

To give you a sense of MOON’s constituents, let’s briefly look at three of the largest weightings:

C3.ai, Inc. (NYSE: AI): As previously noted, the AI theme has been hot. And C3 is one of the top names in the sweltering sector—plus it has arguably one of the hottest ticker symbol around. The company produces an Enterprise AI platform and if the AI frenzy continues, its stock has the potential to reap some of the rewards. According to BMO strategist Brian Belski, "the AI hype surrounding the tech sector is real and likely to propel future growth for many stocks within the space.”

Asana, Inc. (NYSE: ASAN): Companies have tons of projects to organize, and Asana is in the business of helping them do just that. Asana offers a work management platform helping firms ensure their tasks are on track. Asana doesn’t need the work from home trend to succeed. But with more employees working remotely, its platform seems even more compelling.

Arcturus Therapeutics Holdings Inc. (NASDAQ: ARCT): The importance of novel drugs has been underscored by the pandemic and its essential vaccines. Arcturus not only has a drug in development to prevent someone from getting COVID-19, it also uses a similar approach to develop treatments for rare respiratory illnesses. Drug companies are notoriously volatile stocks, but if Arcturus develops a winner its investors could be well-rewarded to say the least.

Second quarter earnings will start to roll out in July. Positive surprises could provide a lift to the early-stage companies held by MOON.

How to Use MOON in a Portfolio

MOON may be considered a satellite holding to seek outperformance while also complementing other broader positions within a portfolio. Granted, MOON isn’t for the faint of heart. But for investors who believe in the power of innovation, we believe the future of MOON’s holdings may deserve a place in today’s portfolios.

*Definitions & Index Descriptions

S&P Kensho Moonshots Index (KMOON) The Index is comprised of 50 U.S. companies that pursue innovative technologies that have the potential to disrupt existing technologies and/or industries (i.e., moonshot innovators) and are considered to have the highest “early-stage composite innovation scores” which is determined based off a natural language processing review of the constituent company’s latest annual regulatory filing for the use of words and phrases that are related to innovation. The Index is modified equal-weighted, reconstituted annually, and rebalanced semi-annually. One cannot directly invest in an index.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at www.direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

The “S&P Kensho Moonshots Index” is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Rafferty Asset Management, LLC (“Rafferty”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Rafferty. Rafferty’s ETFs are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P Kensho Moonshots Index.

Direxion Shares Risks – Investing involves risk including possible loss of principal. There is no guarantee the investment strategy will be successful. The value of stocks of information technology companies and companies that rely heavily on innovation and technology are particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from competitors with lower production costs. Innovative technology companies may struggle to capitalize on new technology or may face competition and obsolescence. Additional risks of the Fund include, but are not limited to, Innovative Technologies Risk, Index Correlation Risk, Index Strategy Risk, Security Volatility Risk, Natural Language Processing Risk, Cash Transaction Risk, Tax Risk, as well as risks related to the market capitalizations of the securities, and the specific industries or sectors, in which the Fund may invest. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Distributor: Foreside Fund Services, LLC.