In 2023, most of the markets for the commodities included in the index (the Auspice Broad Commodity Index) which the Direxion Auspice Broad Commodity Strategy ETF (Ticker: COM) attempts to track were choppy and trended mostly lower. It was a difficult environment for the broad commodity sector as evidenced by the fact that only three out of the twelve commodities which make up the strategy produced positive returns in the past calendar year.

With that said, COM’s ability to be defensive, by being in Cash when an individual commodity is showing a downward price trend, proved to mitigate the downside risk relative to notable commodity index peers in 2023. COM experienced relative outperformance by finishing -2% YTD while peers were down at least -4% or more. Benchmark S&P GSCI Excess Return Index (S&P GSCI)* and Bloomberg Commodity Excess Return Index (BCOM)*, including collateral return, were down -7.9% and - 4.3% respectively.

Please click here for standardized performance of the fund.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns for performance under one year are cumulative, not annualized.

Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes. For additional information, see the fund’s prospectus.

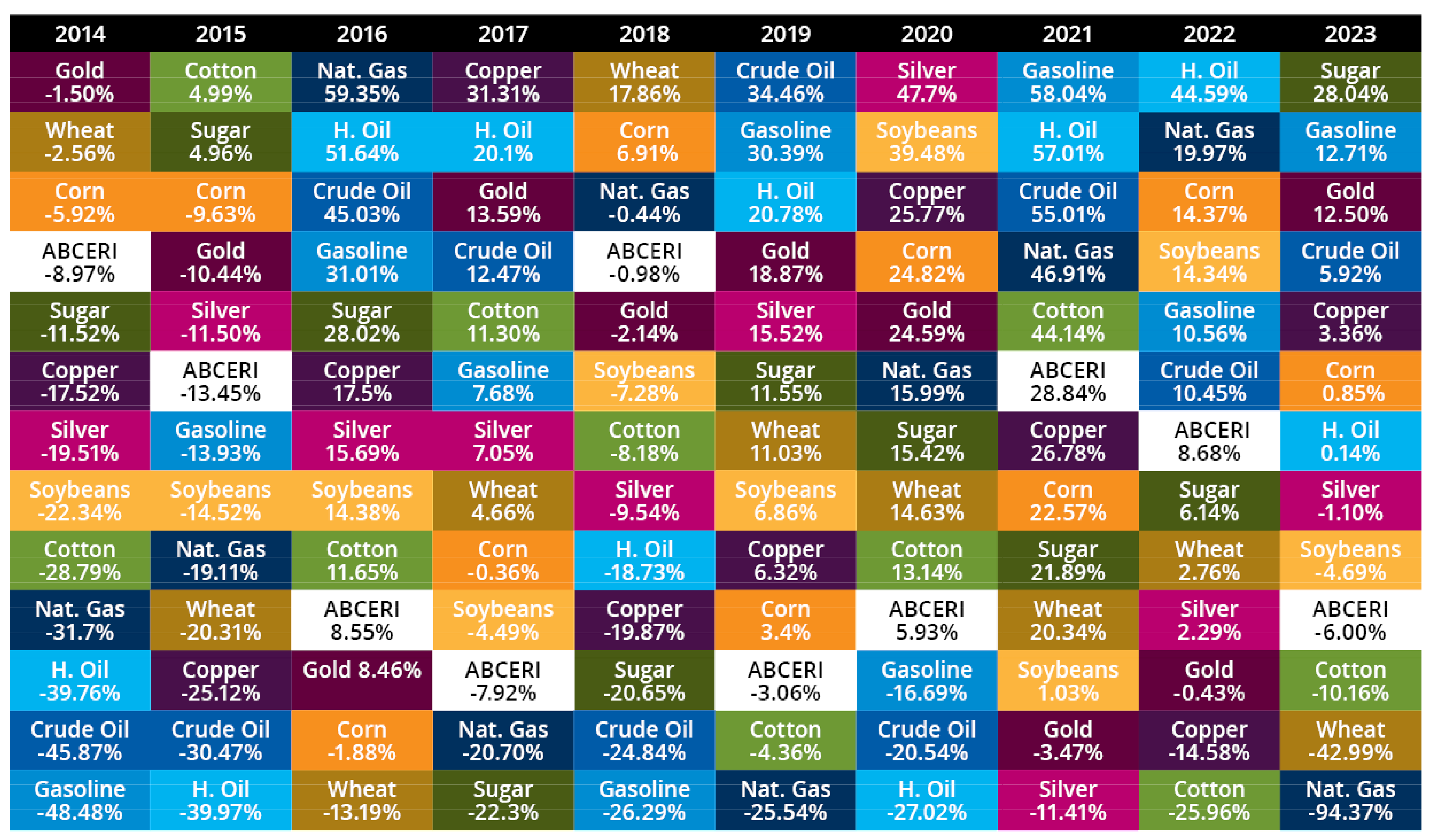

The biggest performance drivers in 2023 were in Sugar and Gold. One of the differentiating factors with COM is its performance attribution can vary year-to-year based on an individual commodity being either Long or in Cash, as well as an equal weighted approach predicated on risk levels.

Generic 1st futures, 01/01/2014 – 12/31/2023. Past performance does not guarantee future results.

COM’s approach is in sharp contrast to most broad commodity strategies that are always fully allocated and maintain static commodity weightings. The COM ETF does not have the concentration risk nor reliance on specific commodities or sectors (such as Energy) to drive performance, which sets it apart from most peers.

Although the Fed has started to pivot toward ending their rate hiking cycle, inflation* remains above its target level and ended the year rising. We will see if the Fed ultimately cuts rates in 2024, but inflation is still persistent and may indicate a structural shift. The anticipation of the Fed cutting rates this year has sent the U.S. Dollar lower in sympathy. If the U.S. Dollar continues to weaken this could be a tailwind for the broader commodity markets, particularly the Precious Metals, as Gold saw a resurgence coinciding with a weaker Dollar as the 4th Quarter unfolded.

As we enter 2024, the biggest potential driver to commodity prices is the current geopolitical risks that pervade in the Middle East, Russia/Ukraine, and China. We believe this ongoing overhang will keep a higher price floor on certain commodity markets, especially Crude Oil. In addition, the global green energy initiatives, and the impact on the reduction of capital expenditure (capex)* spending within commodity related infrastructure could also fuel commodity prices higher.

The Middle East and Russia/Ukraine are two major transportational hubs for a variety of commodities, where disruptions can lead to further global supply chain issues. In the past, we have seen price spikes with Oil and Grain markets from conflict outbreaks in these areas. Russia continues to be the biggest supplier of Natural Gas to Europe, and as we approach the heart of the winter season, a cold spell in Europe combined with any supply chain disruptions could lead to higher prices. We have already seen a recent resurgence in Natural Gas prices early in 2024, after being in the doldrums throughout 2023. In addition, the Black Sea is a major transporter of Grains, as Ukraine is known as the breadbasket of Europe. Food prices remain elevated as evidenced by the costs of staples at the grocery store year over year.

The ongoing tension between the U.S. and China can lead to further regulatory sanctions which could result in elevating commodity markets. The recent election in Taiwan may be foreshadowing as any escalations with China regarding their intentions with Taiwan could have major ripple effects on the global markets.

China’s economy also will continue to be in focus as it comes off a lackluster 2023. Many thought the Chinese economy would have come out roaring in 2023 after the lockdown, but that did not materialize. China is the largest importer of Oil, and a major consumer and producer of a vast number of commodities. Recently, China has illustrated that if their economy languishes, more stimuli will be applied, potentially fueling commodity prices.

Many would now say India is becoming a major factor and demand cog to the commodity markets. That could be the case, as unlike China, India produces little critical commodities for its massive infrastructure spending. India’s population just surpassed China, alongside a rapidly growing middle class adding to that narrative.

As always, when it is all said and done, supply and demand will be the biggest factors in determining the direction of commodity prices. As of January 1, 2024, COM is currently Long in only three (Gold, Silver and Heating Oil) out of the possible 12 commodities within the portfolio. This positioning provides significant ability to add exposure from here as individual merit develops while earning a cash return on the bulk of the portfolio.

To view the Fund’s full positions, click here. Positions are subject to risk and change.

Although 2023 didn’t provide as many individual commodity opportunities as in other years, this year might prove to be different, COM is poised to identify any emerging opportunities that may present themselves.

*Definitions and Index Descriptions

*S&P GSCI Excess Return Index (S&P GSCI) is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities.

*Bloomberg Commodity Excess Return Index (BCOM) is a broadly diversified index that allows investors to track 19 commodity futures through a single, simple measure.

Investing involves risk including possible loss of principal.

An investor should carefully consider the Fund’s investment objective, risks, charges, and expenses before investing. The Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain the Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at www.direxion.com. The Fund’s prospectus and summary prospectus should be read carefully before investing.

Direxion Shares Risks - An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with concentration that results from the Fund’s investments in a particular industry, sector, or geographic region which can result in increased volatility. The Fund’s use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of the Fund include, but are not limited to, Index Correlation Risk, Index Strategy Risk, Derivatives Risk, Commodity-Linked Derivatives Risk, Futures Strategy Risk, Leverage Risk, Counterparty Risk, Cash Transaction Risk, Subsidiary Investment Risk, Interest Rate Risk, and Tax Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Exchange-traded commodity futures contracts generally are volatile and are not suitable for all investors. The value of a commodity-linked derivative investment typically is based upon the price movements of a physical commodity and may be affected by changes in overall market movements, volatility of the index, changes in interest rates, or factors affecting a particular industry or commodity, such as global pandemics, weather and other natural disasters, changes in supply and production, embargoes, tariffs and international economic, political and regulatory developments and changes in speculators' and/or investors' demand. Commodity-linked derivatives also may be subject to credit and interest rate risks that in general affect the value of debt securities. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other investments.

Risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of the instruments held by the Fund and the price of the futures contract; (b) possible lack of a liquid secondary market for a futures contract and the resulting inability to close a futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Index’s inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the Fund has insufficient cash, it may have to sell securities or financial instruments from its portfolio to meet daily variation margin requirements, which may lead to the Fund selling securities or financial instruments at a time when it may be disadvantageous to do so.

Distributor: Foreside Fund Services, LLC.