Direxion Trader Sentiment Survey

Conducted by the Harris Poll

Most active traders knowledgeable about ETFs, generational gap exists in market sentiment.

A vast majority of active traders say they are knowledgeable about exchange-traded funds (ETFs) and feel confident they have the tools to make informed decisions about trading ETFs, according to a new Direxion Trader Sentiment Survey conducted by the Harris Poll on behalf of Direxion.

But while 89% of the 500 active traders surveyed believe they can generate returns trading in both bull and bear markets, Gen Z/Millennial traders proved more likely than Gen X or Boomers/Silent generation traders to expect it will take 12 months or less for the S&P 500 index to return to all-time highs, an overwhelmingly positive outlook on the S&P 500 over the next year, according to the survey conducted in Oct. 2022.

These results confirm active traders in 2022 are in a better position than previous generations to take advantage of opportunities."Ed Egilinsky, Direxion Managing Director and Head of Sales

“These results confirm active traders in 2022 are in a better position than previous generations to take advantage of opportunities,” said Direxion Managing Director and Head of Sales Ed Egilinsky. “Active trading used to be more heavily skewed to older generations due to the requirement of accumulated wealth. There’s more active trading across a broader demographic now since markets are more accessible. That access necessitates education, and validates our commitment to continually educating active traders.”

Active Trader Sentiment on ETFs and the Market

When asked about market sentiment, approximately half of all respondents said they have mostly positive feelings about trading in the current market environment, with the majority feeling optimistic (55%), almost half feeling confident (48%) and excited (47%). Ninety-two percent said they have the tools to trade with intelligence and mitigate risk.

Nearly half of all respondents (49%) said they currently hold ETFs in their portfolio, and 80% of all traders—regardless of whether or not they trade ETFs—said they were very or somewhat knowledgeable about ETFs.

An overwhelming majority of active traders(82%) were very or somewhat confident when making informed decisions about trading ETFs, and 89% believed they could generate returns trading in both bull and bear markets.

It’s a positive sign that ETFs have become integral to so many active traders’ strategies, and that so many have done their homework to understand these investment vehicles."Andy O’Rourke, Direxion Chief Marketing Officer

“It’s a positive sign that ETFs have become integral to so many active traders’ strategies, and that so many have done their homework to understand these investment vehicles,” said Direxion Chief Marketing Officer Andy O’Rourke. “Since the firm’s inception, Direxion has made it a top priority to educate traders through our Education and Insights center, and there’s still work to be done across the industry to educate an even broader swath of traders in a diverse marketplace.”

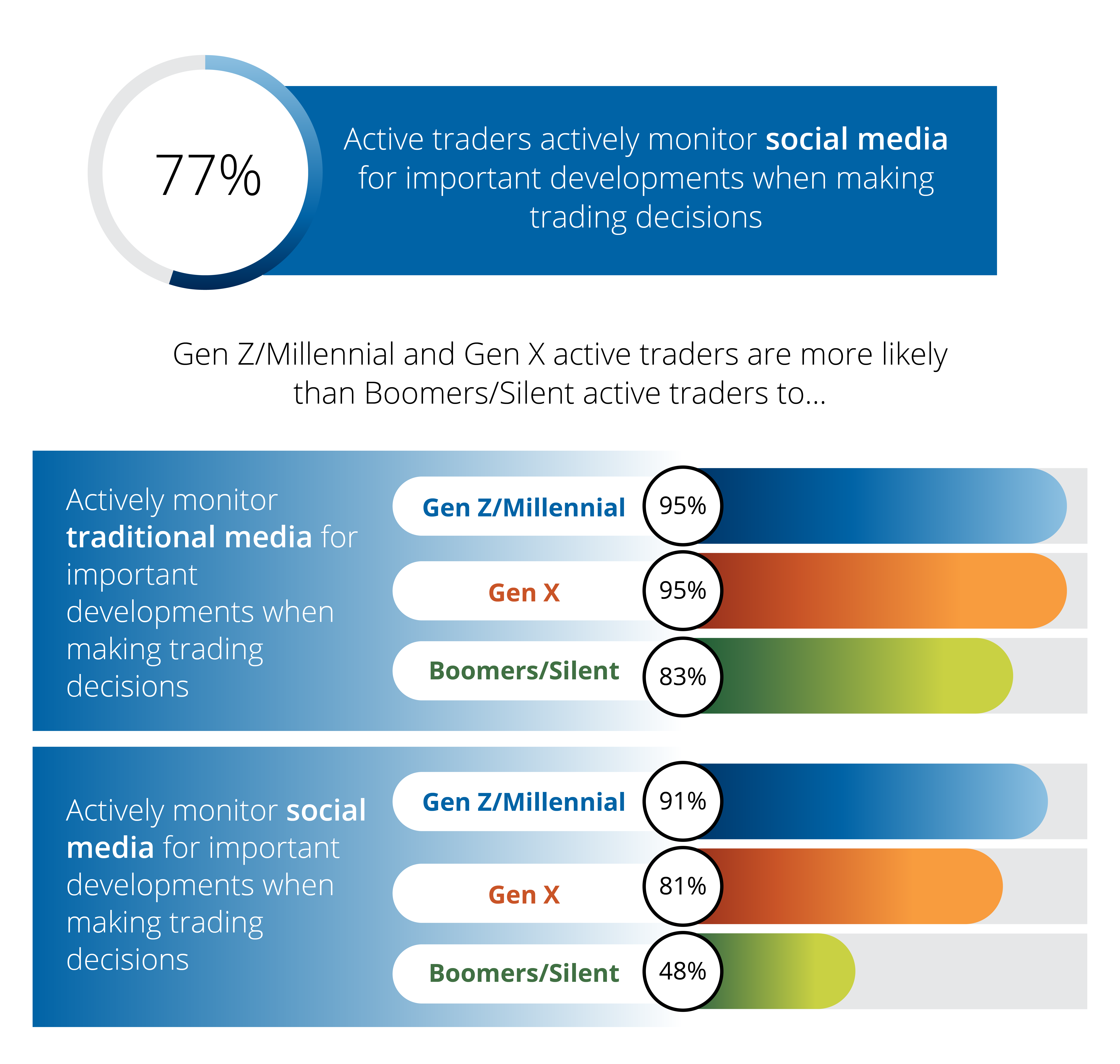

Younger active traders, for example, were more prone to be comfortable with the nuances of leveraged ETFs, with Gen Z/Millennials (60%) and Gen X (61%) more likely to be aware of how the characteristics of leveraged ETFs make them most ideal for short-term trading only.

“Since leveraged ETFs have only been around since 2006, it makes sense that there’s a slight information gap—but that’s changing,” said O'Rourke. “As one of the few providers of leveraged ETFs, Direxion makes great efforts to encourage all active traders do their homework before using the products.”

Since leveraged ETFs have only been around since 2006, it makes sense that there’s a slight information gap—but that’s changing."Andy O’Rourke, Direxion Chief Marketing Officer

Areas of Opportunity

When asked to predict what sectors offer the most significant opportunity for returns over the next six months, 58% of survey respondents were bullish on tech, followed by healthcare (39%) and financials & banking (35%).

ETFs present an opportunity for savvy traders to separate themselves from the pack of others investing purely in things like stocks and mutual funds."Ed Egilinsky, Direxion Managing Director and Head of Sales

Gen X and Boomers/Silent Generation active traders were slightly more bullish on the healthcare/biotech/pharma sector (43% and 38%, respectively) than their Gen Z counterparts (36%).

“ETFs present an opportunity for savvy traders to separate themselves from the pack of others investing purely in things like stocks and mutual funds,” said Egilinsky. “With such a diversity of available ETFs, traders can learn about and deploy various focused strategies if they wish to allocate their portfolios with precision.”

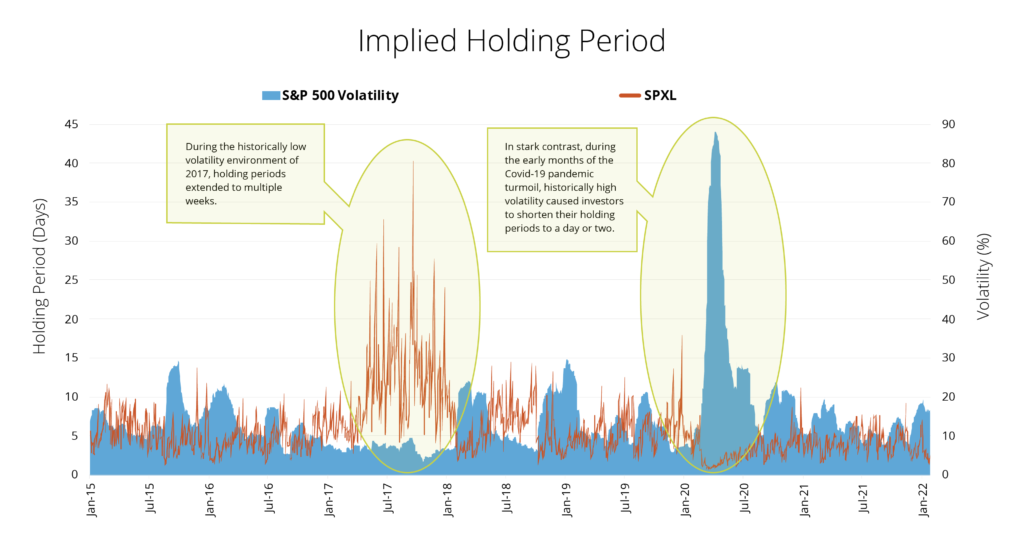

Traders’ Holding Periods Shorten as Volatility Increases. Data sourced through Direxion Leveraged ETF fund flows, highlight the fact that, in the aggregate, there is a direct inverse relationship between volatility levels of the underlying fund target index, and the holding period of the funds. Traders understand that risk characteristics are such that these funds need to be monitored more closely during volatile periods.

Source: Bloomberg Data. 1/1/15-1/1/22 Past performance is no guarantee of future results

The Direxion Trader Sentiment Survey surveyed 500 U.S.-based active traders older than 18 who are very or somewhat involved in making trading decisions that change their portfolio allocations and trade within their account at least monthly with at least $25,000 in investable assets. The survey was conducted from Oct. 21 to 31, 2022.

Survey Methodology: Respondents for this survey were selected from among those who have agreed to participate in our surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within + 4.4 percentage points using a 95%/ confidence level. This credible interval will be wider among subsets of the surveyed population of interest.

For complete survey methodology, including weighting variables and subgroup sample sizes, please contact [email protected].

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or click here. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by a Fund increases the risk to the Fund. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged, or daily inverse leveraged, investment results and intend to actively monitor and manage their investment.

Direxion Shares Risks - An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non-diversified and include risks associated with concentration that results from an ETF’s investments in a particular industry or sector which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The ETFs do not attempt to, and should not be expected to, provide returns which are a multiple of the return of their respective index for periods other than a single day. For other risks including leverage, correlation, daily compounding, market volatility and risks specific to an industry or sector, please read the prospectus.

Distributor: Foreside Fund Services, LLC.