Understanding Leveraged & Inverse Exchange Traded Funds

An Exploration Of The Risks And BenefitsDirexion Leveraged Exchange Traded Funds (ETFs) are daily funds that provide -100%, 200% or 300% leverage or inverse leverage and the ability for investors to navigate changing markets with bull and bear flexibility.

About Direxion Daily Leveraged and Inverse ETFs

Although Direxion Daily Leveraged ETFs share some similarities with non-leveraged ETFs, there are two key concepts that impact the way they are managed and the way they perform:

- Leverage: For 2X and 3X ETFs, each dollar invested provides $2 or $3 of the performance of the benchmark, which means 200% or 300% (or -200% or -300% for leveraged Bear Funds) of the risk and volatility.

- Daily investment objectives: The Direxion Leveraged ETFs seek to magnify, or provide inverse exposure to, the returns of their benchmarks for a single day; returns for periods greater than a day are a product of the compounded daily leveraged returns during the period.

Fund Objectives

Each Direxion Daily Leveraged and Inverse ETF is designed to seek daily leveraged investment results, before fees and expenses, of 300% or 200% of the performance of its benchmark index, for a bull fund (“Bull Fund”), or 300%, 200% or 100% of the inverse (or opposite) of the performance of its benchmark index, for a bear fund (“Bear Fund”). There is no guarantee that the funds will achieve their investment objective.

Investor Suitability

These funds are intended for use only by sophisticated investors who:

- Understand and are willing to accept substantial losses in short periods of time;

- Understand the unique nature and performance characteristics of funds which seek leveraged daily investment results;

- For a Bear Fund, understand the risk of shorting; and

- Have time to manage positions frequently to respond to changing market conditions and fund performance

These funds are not intended for use by conservative investors who:

- cannot tolerate substantial or even complete losses in short periods of time;

- are unfamiliar with the unique nature and performance characteristics of funds that seek leveraged or inverse daily investment results; and

- are unable to manage a portfolio actively and make changes as market conditions and fund performance dictate.

The impact of using Direxion Daily Leveraged ETFs in portfolios:

Direxion offers the highest amount of magnification available in the ETF marketplace today, which increases the level of volatility associated with a particular fund. For example, if the S&P 500® Index increases by 1% in a single day, the Direxion Daily S&P 500® Bull 3X Shares is designed to return approximately 3% on that same day (minus fees and expenses). Conversely, if the same index is down 1% in a day, that same fund would be expected to decrease by approximately 3%.

We recommend that prospective investors seek the advice of an investment professional before making an investment in Direxion Daily Leveraged & Inverse ETFs.

Inside Direxion Leveraged and Inverse ETFs

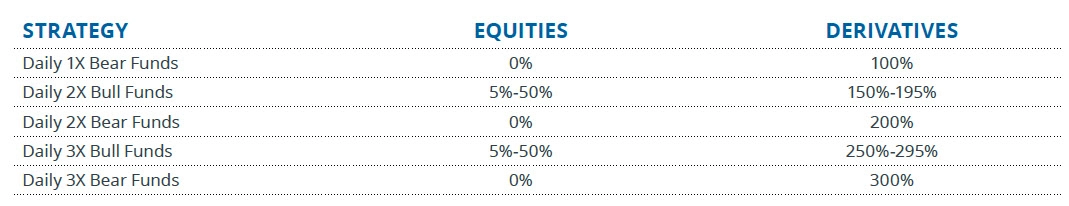

Composition and Exposure

To obtain the necessary exposure, Direxion Daily Leveraged ETFs will invest all or a portion of their net assets in derivatives— typically swaps or futures. These derivatives are agreements that provide the ability to gain exposure to respective indexes and sectors without the need for full dollar-for-dollar investment. The Bull Funds will generate between 10% and 100% of their requisite exposure level from equities and the remainder from derivatives. The Bear Funds generate their entire -100%, -200% or -300% exposure through derivatives.

Managing Exposure in Changing Markets

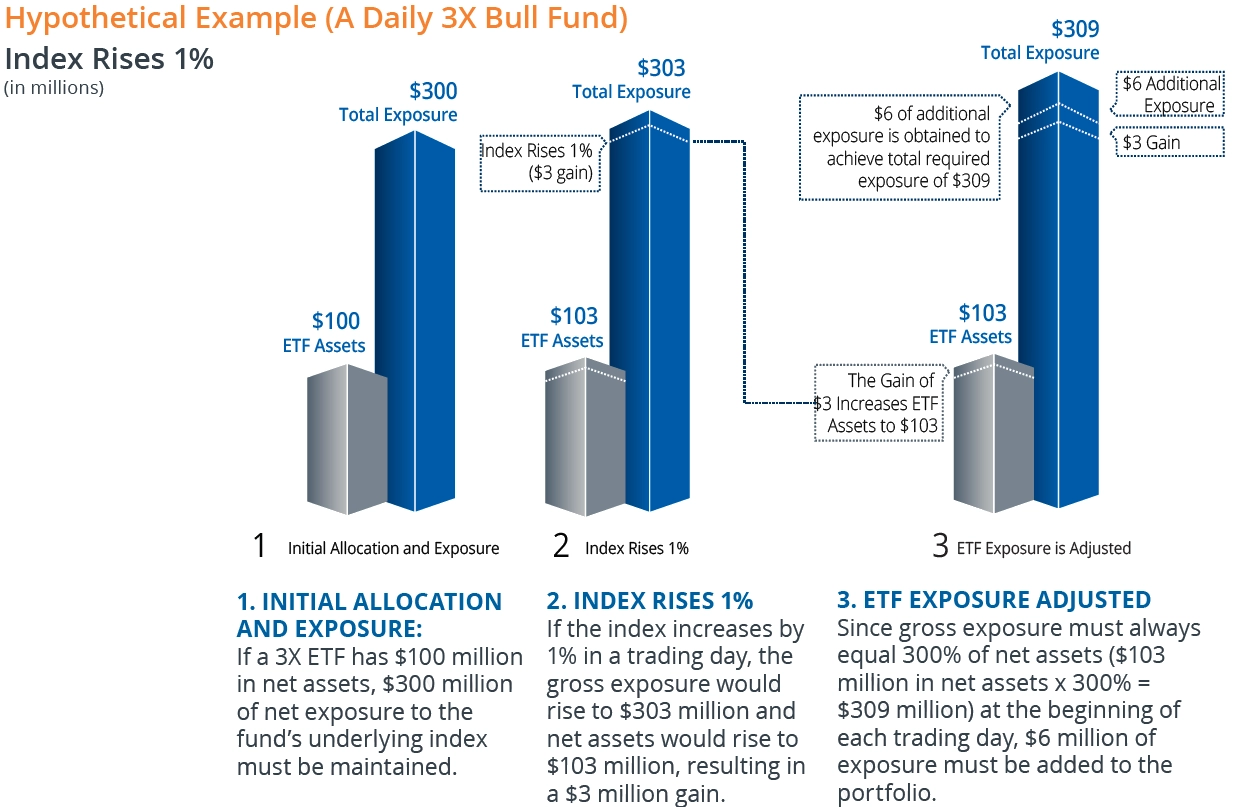

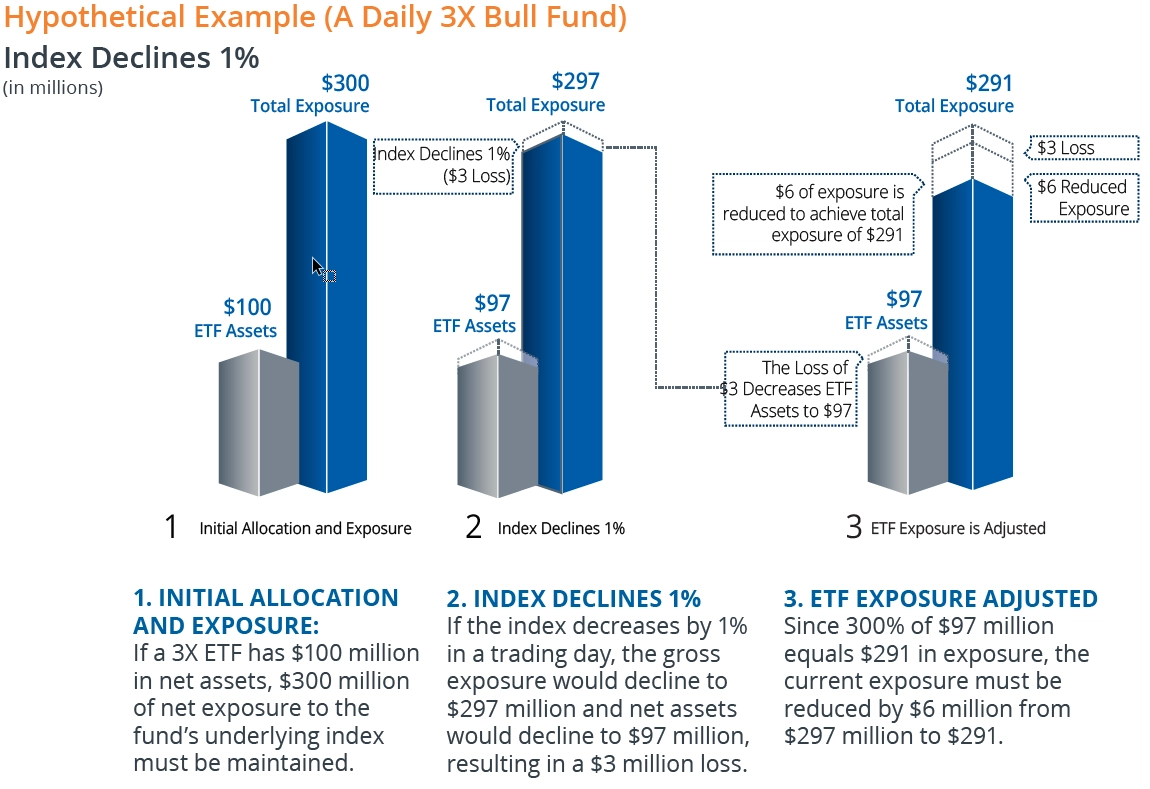

Because Bull and Bear Funds are designed to track the performance, or inverse of the performance, of their respective benchmark indexes, daily market fluctuations will cause the funds’ net asset levels to rise or fall. These daily market fluctuations result in portfolio adjustments by the funds’ adviser, Rafferty Asset Management, LLC (“Direxion”) to help ensure that exposure levels for each Bull and Bear Fund are set at the correct multiple.

Direxion rebalances exposure daily by buying or selling swaps to ensure that each fund tracks as closely as possible to 300% or 200% for a Bull Fund, or 300%, 200% or 100% of the inverse for a Bear Fund, of the benchmark index’s daily performance.

The Impact of Seeking Daily Leverage on Long-Term Performance

Each Direxion Daily Leveraged ETF seeks to provide returns which are a multiple of the return of a particular benchmark index. Daily rebalancing has important implications for the performance of a fund for periods longer than a day.

Why? A daily leveraged fund’s exposure is a product of its target magnification and its net assets. Favorable moves in the benchmark index push net assets higher, which translates into an increase in exposure by a multiple of the gain in its net assets.

Conversely, unfavorable moves in the benchmark index lead to a decline in net assets, which results in a reduction of exposure in an amount which is a multiple of the decline in the net assets.

Ultimately, a daily leveraged fund responds to gains by becoming more aggressive, and responds to losses by becoming more defensive. In markets which are directional, this can be an advantage, in volatile markets which lack direction, this can be a disadvantage.

A Closer Look at Some of the Risks

The following three scenarios illustrate how a Direxion Daily Leveraged 3X Bull Fund performs in various market scenarios:

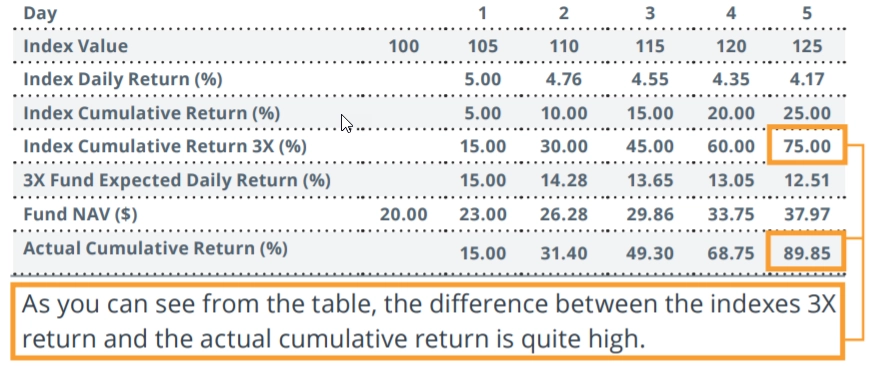

In trending markets with low volatility, the performance for periods longer than a day may exceed the return of the benchmark index, multiplied by the stated exposure level of the portfolio, as demonstrated by the first two scenarios to the below.

1. Market Rises Steadily

If the benchmark index moves in a direction favorable to the fund (meaning up for a Bull Fund and down for a Bear Fund) in a linear trend for a period greater than one day, the fund’s gain for the period may be larger than the cumulative benchmark index return multiplied by the fund’s stated multiple (e.g. 3X, 2X, etc.). This is because as the fund’s net assets rise with the favorable market fluctuation, the fund must respond by increasing its exposure to the benchmark index, which therefore amplifies the impact of subsequent favorable index movements.

No fees and expenses are taken into account in the table above.

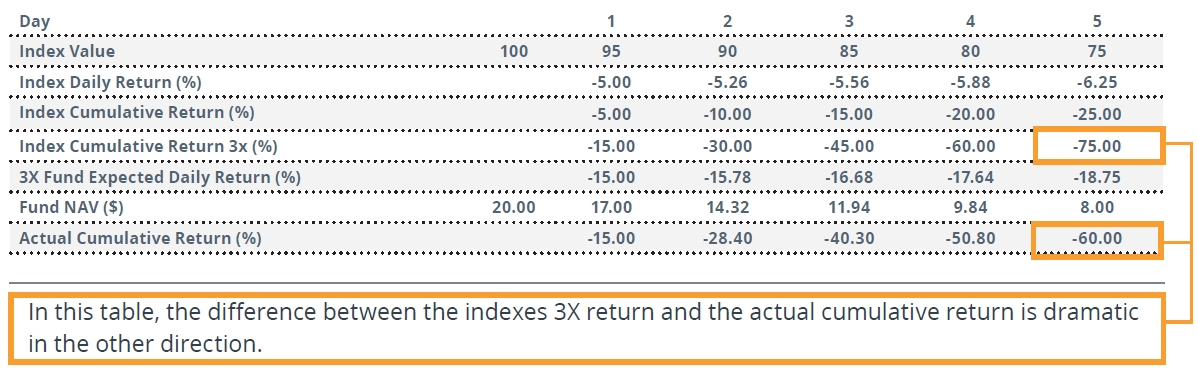

2. Market Declines Steadily

If the benchmark index moves in a direction unfavorable to the fund (meaning down for a Bull Fund and up for a Bear Fund) in a linear trend for a period greater than one day, the funds losses for the period may be smaller than the cumulative benchmark index return multiplied by the fund’s stated multiple (e.g. 3X, 2X, etc.) This is because, as the fund’s net assets decline with the downward market fluctuation, the fund must respond by decreasing its exposure to the index, which therefore reduces the impact of subsequent unfavorable index movements.

3. Market is Flat, Yet Volatile

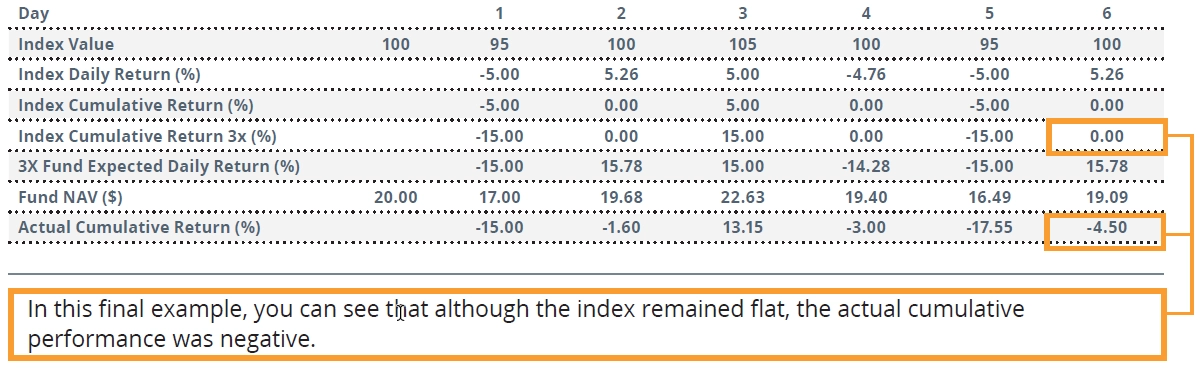

In volatile markets that exhibit no clear trend or direction, the impact of daily rebalancing can be harmful to the performance of leveraged ETFs over time. As described above, the funds respond to gains by increasing exposure to the benchmark index, and respond to losses by decreasing exposure each day. Increased exposure in advance of a loss will generate a larger loss, and decreased exposure in advance of a gain will decrease the impact and benefit of future gains for the fund. A continued pattern of this sort will typically cause the decay of the longer term returns of the fund. In the table below we see an example of a fund that had a negative return after a six day period of volatile yet cumulatively flat benchmark index returns. You can follow the math to better understand how this occurs.

These numbers do not reflect the daily operating expenses and financing charges, are hypothetical in nature, and are not representative of actual Direxion Daily Leveraged ETF returns. Users of Direxion Daily7 Leveraged ETFs are encouraged to monitor the changing exposure provided by their investment and modify share holdings as they deem necessary.

Market Price Variance Risk

Direxion Daily Leveraged ETFs are a part of the Direxion Shares ETF Trust (“Direxion Shares”) are bought and sold in the secondary market on the NYSE ARCA, Inc., The Nasdaq Stock Market, LLC, and other exchanges. The market prices of the shares will fluctuate in response to changes in net asset value (NAV) and supply and demand for the shares. It is not possible to accurately predict whether the shares will trade above, below, or at their NAV. On occasion, ETFs may trade at larger-than expected premiums due to a lack of supply of outstanding shares available in the markets. The result could be that an investor may buy shares at a price that is somewhat inflated above the total market value of the underlying holdings of the fund. However, as more shares are introduced into the secondary market, supply and demand ordinarily return to relative balance. The result typically would be a natural decrease in the size of the premiums.

Counterparty Risk

Direxion Shares may invest in financial instruments involving counterparties for the purpose of attempting to gain added exposure to the benchmark indexes.

Counterparty risk is the risk of monetary loss a firm may be exposed to if the counterparty encounters difficulty meeting its contractual obligations under the terms of the transaction.

Direxion strives to minimize counterparty risk primarily by diversifying its portfolio of relationships for swap and futures contracts across multiple brokers. Direxion will regularly monitor the balance sheets of all counterparties and will suspend or terminate relationships with any organization that, in the opinion of Direxion or its affiliates, shows material signs of insolvency.

Terms leveraged ETF investors should know:

Beta - A measure of the systematic variability of a security or a portfolio in relation to a target index. A beta of more than 1.00 indicates that the security or portfolio would have higher volatility than the index; a beta of less than 1.00 indicates lower volatility.

Counterparty - In financial service terms, counterparty can refer to brokers, investment banks, and other securities dealers that serve as the contracting party when completing “over-the-counter” securities transactions. The term is generally used in this context in relation to “counterparty risk,” which is the risk of monetary loss a firm may be exposed to if the counterparty to an over-the-counter securities trade encounters difficulty meeting its obligations under the terms of the transaction.

Futures Contract - A contract, traded on a futures exchange, to buy or sell a standardized quantity of a specified commodity of standardized quality (e.g., a “basket” of corporate equities [“stock indices”] at a certain date in the future, at a price (the futures price) determined by the market price at the time of the purchase or sale of the contract.

INAV (the Intraday NAV) - Used as a reference for an ETF’s underlying value during trading hours, prior to market close. In many cases, the ETF will trade at a premium or discount to the NAV due to various factors, including supply and demand. Calculating INAV prior to purchasing an ETF allows you to determine whether you are purchasing it at a premium or a discount to the ETF’s NAV.

Secondary Market - The financial market for trading of securities that have already been issued in an initial private or public offering. New ETF shares are created in the primary market in large lots called creation units by financial professionals called Authorized Participants. Once these shares are created, they become available for purchase to all investors in the secondary market.

Swap - A derivative in which two counterparties agree to exchange one stream of cash flows for another stream. These streams are called the legs of the swap.

The cash flows are calculated over a notional principal amount, which is usually not exchanged between counterparties. Consequently, swaps can be used to create unfunded exposures to an underlying asset, since counterparties can earn the profit or loss from movements in price without having to post the notional amount in cash or collateral.

(Direxion uses swaps to obtain additional exposure, or inverse exposure, to the benchmark indexes that the funds track.)

Frequently Asked Questions

Direxion Daily Leveraged & Inverse ETFs are investment vehicles for active, sophisticated investors who are looking to gain magnified or inverse exposure to the markets. This brochure has provided a detailed explanation as to how these funds operate, as well as a description of certain risks that must be understood before investment is made. It is also important to remember that, particularly in volatile markets, these funds must be monitored closely to ensure that one’s exposure levels are in line with their desired objectives.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns for performance under one year are cumulative, not annualized. For the most recent month- end performance please visit the funds website at direxion.com.

Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes. For additional information, see the fund’s prospectus.

Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged, or daily inverse leveraged, investment results and intend to actively monitor and manage their investment. The Direxion Shares ETFs are not designed to track their respective underlying indices over a period of time longer than one day.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Shares ETF Risks - An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non-diversified and include risks associated with concentration that results from an ETF’s investments in a particular industry, sector or company, which can increase volatility. The leveraged and inverse ETF utilize derivatives, such as futures contracts and swaps which are subject to market risks that may cause their price to fluctuate over time. The leveraged and inverse ETFs do not attempt to, and should not be expected to, provide returns which are a multiple of the return of their respective index or company for periods other than a single day. The leveraged and inverse ETFs may also subject to leverage, correlation, daily compounding, market volatility and risks specific to an industry, sector or company.

Distributor: Foreside Fund Services, LLC.

Still Have Questions About Leveraged & Inverse ETFs?

If you have questions about Direxion or our investment products, this is the right place. Read more to get answers to our most frequently asked questions.