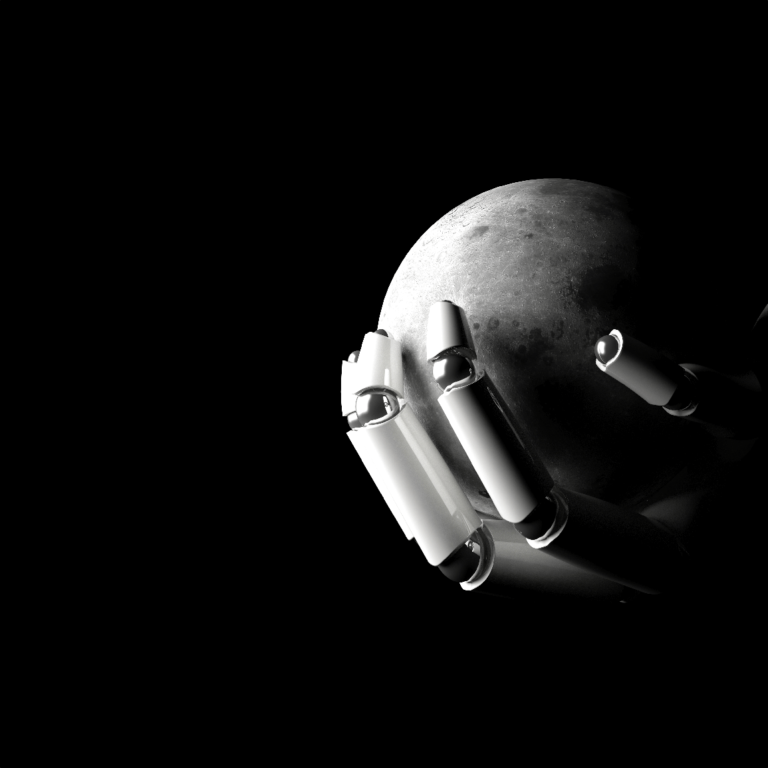

What’s the Big Deal about Direxion’s Moonshot Innovators ETF (MOON)

The Direxion Moonshot Innovators ETF offers exposure to the 50 most innovative US companies at the forefront of changing our lives today, and tomorrow, by identifying the companies both pursuing innovation, and having the potential to disrupt existing technologies and/or industries. These 50 companies selected for inclusion are deemed to have the highest “early-stage composite innovation scores” and they span themes and emerging sectors such as smart transportation, clean power, and the human evolution. The early stage composite score is based on a company’s “allocation to innovation” and “innovation sentiment” score.

The “S&P Kensho Moonshots Index” is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Rafferty Asset Management, LLC (“Rafferty”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Rafferty. Rafferty’s ETFs are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P Kensho Moonshots Index.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Risks – Investing involves risk including possible loss of principal. There is no guarantee the investment strategy will be successful. The value of stocks of information technology companies and companies that rely heavily on innovation and technology are particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from competitors with lower production costs. Innovative technology companies may struggle to capitalize on new technology or may face competition and obsolescence. Additional risks of the Fund include, but are not limited to, Index Correlation/Tracking Risk, Index Strategy Risk, Market Disruption Risk, and risks associated with the market capitalizations of the securities in which the Fund may invest. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.