Moonshot Money in Motion – MOON ETF

David Mazza, Managing Director, Head of Product

What Happened to Moonshots Stocks and the MOON ETF in 2021?

The S&P Kensho Moonshots Index measures the performance of 50 US, early-stage companies with the highest innovation allocation and sentiment. Innovation allocation represents the ratio of research and development expenses to revenue compared to other companies in the same industry. Innovation sentiment is based on a review of a company’s regulatory filings for the previous 12 months for the use of words related to innovation. These 50 companies produce the products and that have the potential to shape our future.

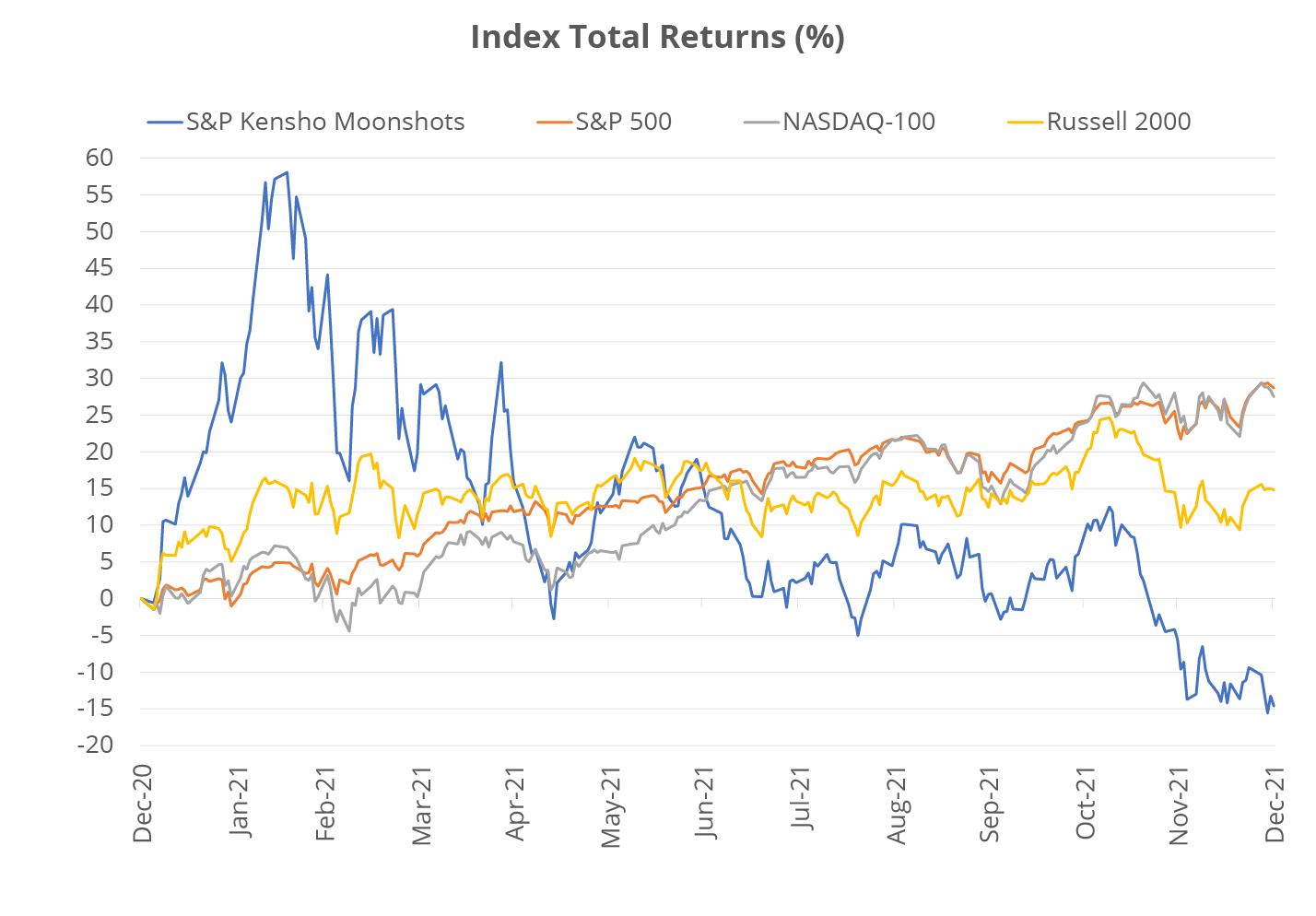

In 2021, innovation as a theme was out of favor, thanks to expectations of an improving economy and increased interest rates driving a rotation away from growth to value. Thematically, Virtual Reality was the top performing theme, followed by Robotics and Advanced Transportation Systems. Laggards included Cleantech, Digital Communities and Genetic Engineering.

For the full year, the S&P Kensho Moonshots Index declined nearly 15%. From a sub-industry perspective, overweights and security selection in Biotechnology was by far the greatest detractor from performance. At the stock level, Oneconnect Financial Technology Co., Ltd. (OCFT) down 87%, Workhorse Group Inc. (WKHS) down 78%, and ImmunityBio, Inc. (IBRX) down 54% were the largest laggards.

Moonshots Underperformed in 2021

Source: Bloomberg Finance, L.P., as of December 31, 2021.

Moonshot Stocks: Out with the Old, In with the New

While 2021 was challenging for Moonshots stocks, the past is the past. Looking ahead, investors and traders should focus on what the current exposures are and how they may fare going forward. Fortunately, the S&P Kensho Moonshots Index employs a systematic approach to identifying the 50 most innovative early-stage companies. In December 2021, the Index underwent its most rebalance. Two of the recent additions – Gritstone bio, Inc. (GRTS) and A10 Networks Inc (ATEN) – are top 10 holdings.

The Moonshots Index Experienced 11 Additions and 11 Deletions

| Additions in December 2021 | |||

| Name | Ticker | Sub-Theme | GICS Sub-Industry |

| Gritstone bio, Inc. | GRTS | Genetic Engineering | Biotechnology |

| A10 Networks Inc | ATEN | Cyber Security | Systems Software |

| Recursion Pharmaceuticals, Inc. Class A | RXRX | Genetic Engineering | Biotechnology |

| C3.ai, Inc. Class A | AI | Smart Factories | Application Software |

| Butterfly Network, Inc. Class A | BFLY | Digital Health | Health Care Equipment |

| Stem Inc. | STEM | Smart Grids | Electrical Components & Equipment |

| Aeva Technologies, Inc. | AEVA | Autonomous Vehicles | Electronic Equipment & Instruments |

| Ouster, Inc. | OUST | Autonomous Vehicles | Electronic Equipment & Instruments |

| TuSimple Holdings Inc. Class A | TSP | Autonomous Vehicles | Trucking |

| View, Inc. | VIEW | Smart Buildings | Building Products |

| Canaan Inc. | CAN | Distributed Ledger | Technology Hardware Storage & Peripherals |

| Deletions since June 2021 | |||

| Name | Ticker | Sub-Theme | GICS Sub-Industry |

| MongoDB, Inc. | MDB | Internet Services & Infrastructure | |

| Radware Ltd | RDWR | Cyber Security | Communications Equipment |

| Slack Technologies, Inc.-A | WORK | Enterprise Collaboration | Application Software |

| Aerovironment Inc | AVAV | Drones | Aerospace & Defense |

| Mercury Systems Inc | MRCY | Drones | Aerospace & Defense |

| Sohu.com Inc ADR | SOHU | Digital Communities | Interactive Media & Services |

| F5 Networks Inc | FFIV | Cyber Security | Communications Equipment |

| iRobot Corp | IRBT | Robotics | Household Appliances |

| Super League Gaming, Inc. | SLGG | Digital Communities | Interactive Media & Services |

| Orchard Therapeutics PLC | ORTX | Genetic Engineering | Biotechnology |

| Xunlei Ltd. | XNET | Distributed Ledger | Application Software |

Source: S&P Kensho, as of December 31, 2021.

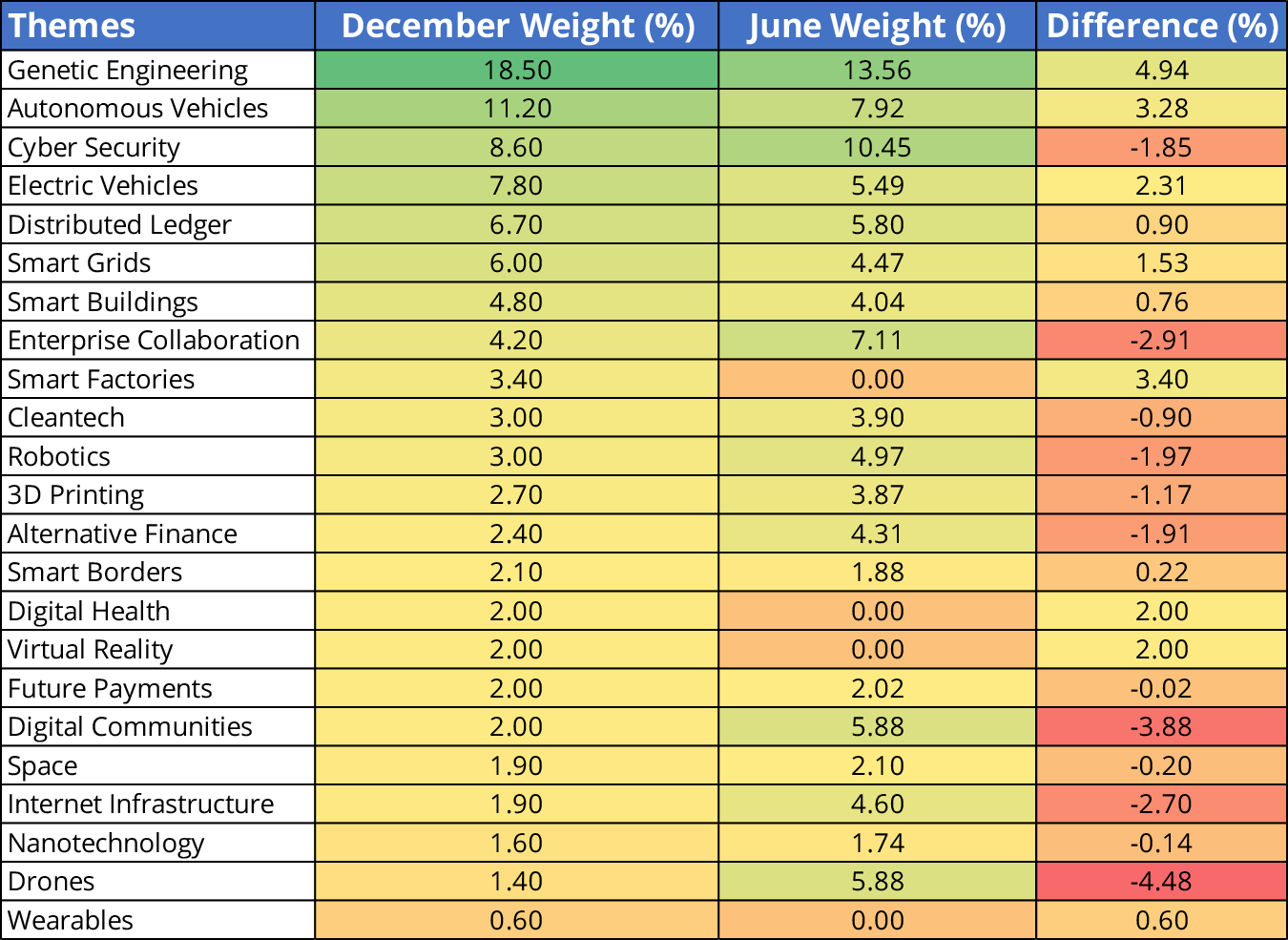

With close to a 5% increase at the December rebalance, Genetic Engineering is the largest theme represented in the S&P Kensho Moonshots Index, with over 18% exposure. Autonomous Vehicles and Cyber Security are the second and third largest themes, respectively. Genetic Engineering, Smart Factories and Autonomous Vehicles saw the largest increases, while Drones, Digital Communities and Enterprise Collaboration experienced the greatest decreases.

At the sector level, Information Technology is the largest weight (45%), followed by Health Care (22%) and Industrials (22%). This level of turnover is consistent with expectations and the Index’s history.

Genetic Engineering Remains the Largest Moonshots Theme

Source: S&P Kensho, as of December 31, 2021.

2022 MOON ETF Outlook

Looking toward 2022, Direxion Moonshot Innovators ETF performance will likely see macro factors, such as interest rates and inflation, drive performance, but the strategy’s tilt toward disruptive innovation remains attractive. One reason is simply a means to diversify away from the mega caps continuing to dominate the majority of indexes and certain active funds. Compared to the broader stock market, the S&P Kensho Moonshots Index skews toward smaller cap stocks with higher than average volatility and higher expected growth prospects1. At the end of the day, as these exposures go, Moonshots will go and so will the Direxion Moonshot Innovators ETF (Ticker: $MOON ETF).

Kensho Moonshots Index Top 10 Holdings

| Name | Ticker | Sub-Theme | GICS Sub-Industry | Weight (%) |

| Arcturus Therapeutics Holdings Inc. | ARCT | Genetic Engineering | Biotechnology | 2.97 |

| Gritstone bio, Inc.* | GRTS | Genetic Engineering | Biotechnology | 2.38 |

| ProQR Therapeutics BV | PRQR | Genetic Engineering | Biotechnology | 2.36 |

| Adaptimmune Therapeutics plc ADR | ADAP | Genetic Engineering | Biotechnology | 2.36 |

| ImmunityBio, Inc | IBRX | Genetic Engineering | Biotechnology | 2.33 |

| Juniper Networks Inc | JNPR | Cyber Security | Communications Equipment | 2.24 |

| Netscout Systems Inc | NTCT | Cyber Security | Communications Equipment | 2.21 |

| CRISPR Therapeutics AG | CRSP | Genetic Engineering | Biotechnology | 2.18 |

| BIT Mining Limited | BTCM | Distributed Ledger | Application Software | 2.16 |

| A10 Networks Inc* | ATEN | Cyber Security | Systems Software | 2.16 |

Source: Bloomberg Finance, L.P., as of December 31, 2021. *Denotes new addition in December 2021. Holdings subject to change.