Direxion Work From Home ETF (WFH): 2Q Earnings Overview

Editor’s note: Any and all references to time frames longer than one trading day are for purposes of market context only, and not recommendations of any holding time frame. Daily rebalancing ETFs are not meant to be held unmonitored for long periods. If you don't have the resources, time or inclination to constantly monitor and manage your positions, leveraged and inverse ETFs are not for you.

As Q2 earnings take a hit from COVID-19, the pandemic may have tilted the playing field for the technology heroes of a secular move towards remote productivity. Forward thinking investors may find the opportunity in this space is a growing one.

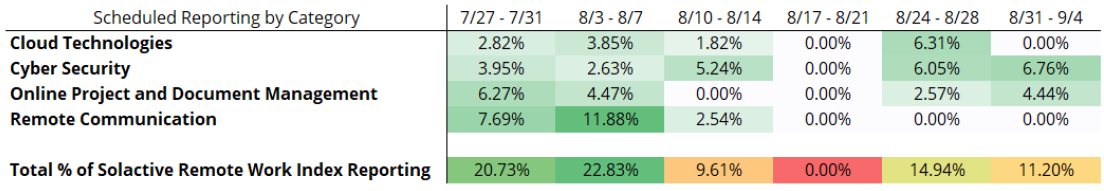

There are four technological pillars sitting at the core of the remote work revolution: cloud technologies, cyber security, online project and document management, and remote communication. While some of these companies are well-established companies, any are not yet household names, but offer some of the most interesting opportunities for investors. In fact, the combination of both large and small firms in the Solactive Remote Work Index, WFH’s benchmark index*, makes for a more diverse implementation as opposed to simply choosing one or two names for exposure.

As 2Q earnings season progresses, investors should keep an eye on upcoming earnings releases from names like VMware (NYSE: VMW), Fortinet (NASDAQ: FTNT), Zoom Video (NASDAQ: ZM), Twilio (NYSE: TWLO), and Inseego (NASDAQ: INSG), to help understand how greater adoption of remote work is progressing.

Source: Bloomberg, L.P. as of 7/22/2020.

Cloud Technologies

With 62% of U.S. employees working from home1 in mid-April (up from an already elevated 31% in mid-March), and signs of more permanent work-from-anywhere solutions taking place, cloud adoption is expected to increase even further. In 2019, enterprise spending on cloud infrastructure ($97 billion) surpassed spending on data center hardware and software ($93 billion)2 for the first time ever, and with the current environment presenting unforeseen difficulties for managing on premise infrastructure, businesses will look to become even more flexible with cloud solutions.

- Inseego Corp (NASDAQ: INSG, expected 8/5): Revenue: $79.8 million, +50% yoy

Inseego is positioning itself to be an early leader in the 5G rollout, and looks to be poised to benefit from the work- from-home revolution by delivering secure connectivity solutions. While the stock has gained 49.5% (as of 7/22) this year, we expect revenue growth to justify the price appreciation.

- VMware (NYSE: VMW, expected 8/23): Revenue: $2.80 billion, +15% yoy

Last quarter, management noted that despite the pandemic, customers were continuing to spend on their migration to the cloud, and they cited that they believe that the pandemic has “…driven a decade of digital transformation in a few short weeks.”3 VMware has continued to provide major updates to their core portfolio of products across the VMware Cloud Foundation.

Source: Bloomberg, L.P. as of 7/22/2020.

1Gallup (2020): “Reviewing Remote Work in the U.S. under COVID-19”

2Synergy Research Group (2020): “The Decade’s Megatrends in Numbers”

3Patrick Gelsinger, Chief Executive Officer, VMware, Q1 Conference Call Transcript

Cyber Security: Security will Remain a Top Priority as the Workplace Expands

In 2019, cyber security and analytics was the #2 priority in the Goldman Sachs 2019 IT Spending Survey, with public cloud spend #3. As the workforce in the U.S. and around the globe becomes more mobile, the tailwind behind cyber security has only intensified. Different businesses will require different security needs based on many factors, thus, the entire space is worth paying close attention to.

- CrowdStrike (NASDAQ: CRWD, expected 9/3): $188.4 million, +76% yoy

So far in 2020, the momentum behind the stock price has been justified as they reported an 85% increase ($178.1M) in revenue yoy. While EPS is expected to still be negative, revenue is expected to increase to $188.4M in the second quarter. We will be watching for any updates to the fiscal year guidance they provided last quarter, citing an expected 72% to 76% growth in revenue.

- Fortinet (NASDAQ: FTNT, expected 8/6): $599.2 million, +15% yoy

Expectations may have been too low for Fortinet last quarter, as they handily beat expectations on both the top and bottom line. With even stronger growth for Fortinet coming from customers in the EMEA (Europe, the Middle East, and Africa) and APAC (Asia-Pacific) regions, revenue is expected to grow again in the second quarter.

Source: Bloomberg, L.P. as of 7/22/2020.

Online Project and Document Management: Prioritizing Productivity for the Evolving Workplace

Along with investing in a more mobile, more agile workplace, businesses will work to support to productivity, creativity, and collaboration both internally and externally. Currently, many content collaboration platforms are primarily used to file and store data, documents, spreadsheets, etc. These capabilities are poised to expand as needs develop from a more mobile workforce.

- Box (NYSE: BOX, expected 8/27): $189.6 million, +10% yoy

While Box does cater their cloud-collaboration software to small-to-medium businesses, where enterprise spend may potentially be less compared to larger clientele, revenue is expected to increase in the second quarter to $189.6M, and EPS is expected to be the most positive in company history ($0.12 per share).

- Atlassian (NYSE: TEAM, expected 7/30): $410.8M million, +23% yoy

With products ranging from project and issue tracking, enterprise planning, to document collaboration, Atlassian is poised to benefit from the increased demand in this category. With their subscription revenue on a steady rise, customers are expanding their usage of the product suite to address growing needs.

Source: Bloomberg, L.P. as of 7/22/2020.

Remote Communication: Communication Digitized

In a matter of months, remote communications have already become the standard form of communication for many businesses, both internally and externally. With the rise of platforms like Zoom and Twilio, remote communication and the infrastructure for it is here to stay as it is built for the scalability and flexibility needed for the new mobile workplace.

- Zoom Video (NASDAQ: CRWD, expected 9/3): $188.4 million, +76% yoy

So far in 2020, the momentum behind the stock price has been justified as they reported an 85% increase ($178.1M) in revenue yoy. While EPS is expected to still be negative, revenue is expected to increase to $188.4M in the second quarter. We will be watching for any updates to the fiscal year guidance they provided last quarter, citing an expected 72% to 76% growth in revenue.

- Twilio (NYSE: TWLO, expected 8/4): Revenue: $367.8 million, +34% yoy

The remote work revolution is fast-forwarding the demand for Communication Platforms as a Service (CPaaS), a software probably most apparent in e-commerce. Twilio is likely to play a key role in the evolution of how businesses communicate with their customers via text, voice, video, and email.

Trends toward a greater adoption of flexible work arrangements were already in motion prior to the COVD-19 pandemic, which has and may continue to accelerate adoption of technologies that enable remote work.

The Direxion Work From Home ETF offers exposure to companies across these four technology pillars, allowing investors to gain exposure to those companies that stand to benefit from an increasingly flexible work environment. The fund’s index utilizes a proprietary algorithm to evaluate large volumes of publicly available information, such as annual reports, business descriptions and financial news to identify the 40 stocks accelerating greater adaption of remote work.

Invest in the Remote Revolution Now

WFH Index Top 10 Holdings (as of 6/30/20)

| Twilio - Class A | 4.45 |

| Inseego | 4.15 |

| Crowdstrike Holdings | 4.13 |

| Zoom Video Communications | 4.05 |

| Elastic | 3.08 |

| Okta - Class A | 3.08 |

| Ping Identity Holding | 3.05 |

| Box | 2.99 |

| Fortinet | 2.75 |

| Amazon.com | 2.67 |

* The Direxion Work From Home ETF (the “Fund”) seeks investment results, before fees and expenses, that track the Solactive Remote Work Index (the “Index”). There is no guarantee that the fund will achieve its stated investment objective.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-301-9214 or visit our website at direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Market Disruptions Resulting from COVID-19. The outbreak of COVID-19 has negatively affected the worldwide economy, individual countries, individual companies and the market in general. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to the Fund.

CUSIP Identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by Standard and Poor’s Financial Services, LLC, and are not for use or dissemination in any manner that would serve as a substitute for a CUSIP service. The CUSIP Database, ©2011 American Bankers Association. “CUSIP” is a registered trademark of the American Bankers Association.

Solactive AG is not a sponsor of, or in any way affiliated with, the Direxion Work From Home ETF.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Shares ETF Risks- Investing involves risk including possible loss of principal. There is no guarantee the investment strategy will be successful. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from competitors with lower production costs. ADRs are issued by non-U.S. companies and are subject to various foreign investment risks including but not limited to the risk that the currency in the issuing company’s country will drop relative to the U.S. dollar, that politics or regime changes in the issuing company’s country will undermine exchange rates or destabilize the company and its earnings. Additional risks of the Fund include, but are not limited to, Index Correlation/ Tracking Risk, Index Strategy Risk, Market Disruption Risk, American Depositary Receipts Risk and risks associated with the market capitalizations of the securities in which the Fund may invest. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Distributor: Foreside Fund Services, LLC.