Source: Bloomberg Finance, L.P., as of September 30, 2021.

Ears of Gold and Bars of Corn and the Commodity Strategy ETF

All Commodities Investments are Not Created Equal.

WHY TRADING COMMODITY ETFS, LIKE COM, MAY BE WARRANTED: IS INFLATION TRANSITORY? NO. AND ALSO YES.

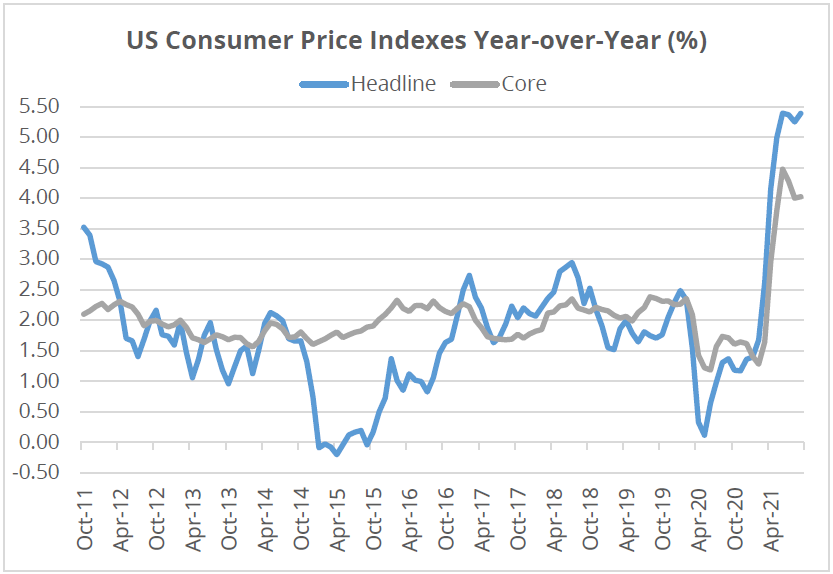

Due to demographics and technological advancements, the case for a continued deflationary environment over the long- term is strong (a la Japan). However, ignoring the recent inflationary pressures may be detrimental to portfolios. With a 0.4% increase from August (estimates were for a 0.3% increase), September’s Consumer Price Index (CPI)1 registered a 5.4% year- over-year gain and sits at a 30-year high. This matches June’s numbers and is again the highest annual increase since 2008. Core inflation increased 0.2% month-over-month matching economist estimates. Core CPI has been above 4% since June, highlighting signs of stickiness even when excluding food and energy prices. In addition, both the trimmed mean and median levels remain elevated relative to their history, suggesting outliers are not affecting the data. Meaning – this is more than just used car prices or the reopening of the service economy driving these outsized gains.

CONSUMER PRICE INDEX CONTINUES RUN HOT

PERSISTENT PRICING PRESSURES COULD BODE WELL FOR COMMODITY TRADERS

Atlanta Fed President Bostic went as far in a recent speech to put “transitory” in a swear word jar, acknowledging pricing pressures are sticking around longer than anticipated. Looking at Core CPI, most concerning is the rent component experienced strong increases, which tend to be sticky. Importantly, this is the last CPI report before the next FOMC meeting, as investors read what the Fed may do regarding tapering their asset purchases. All of this comes as concerns about supply chains grow heading into the holiday season and energy shortages remain in the news in Europe. This points to the potential for more broad-based pricing pressures than expected, and that base effects from the economic shutdown in the depth of the pandemic cannot continue to take the blame.

ARE ECONOMISTS TOO OPTIMISTIC?

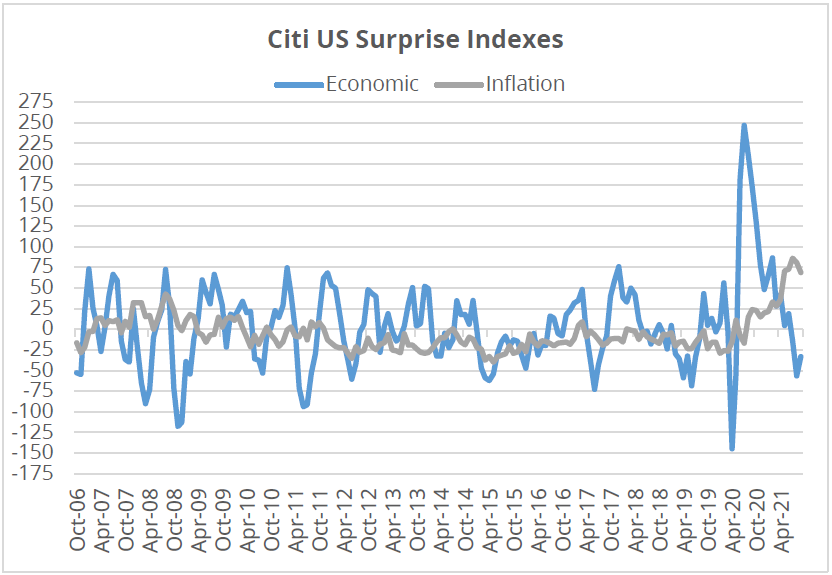

An increased concern for investors may be the idea of stagflation. Recently, economic data releases are surprising to the downside, implying economists are too optimistic on growth. At the same time, inflation readings are surprising to the upside, highlighting economists may be too sanguine about pricing pressures.

INFLATION DATA IS SURPRISING TO THE UPSIDE, WHILE ECONOMIC DATA IS SURPRISING TO THE DOWNSIDE

Source: Bloomberg Finance, L.P., as of September 30, 2021

NOT ALL COMMODITIES ARE CREATED EQUAL

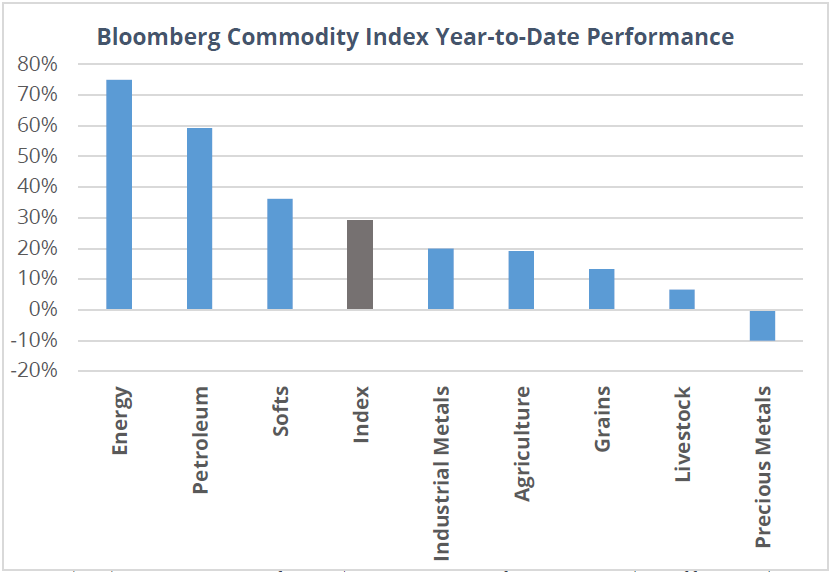

Investors have historically looked to commodities to help navigate inflationary environments. However, the challenge with commodities is they are not a homogeneous asset class. Since most would not confuse an ear of corn with a gold bar, investors should not expect their returns to behave similarly since their drivers of supply and demand are incredibly different. Year-to-date, the broad commodity index is up 29%, but the difference between the best performing single commodity is massive – 138% to be exact. Specifically, after rising 33% in September thanks to concerns about production and supply disruption due to an active hurricane season, Natural Gas is up a whopping 113% on the year, while Soybean Meal is down 26%. The difference between the best and worst commodity in September alone was 42%, giving reason that investing in a broad commodity index ETF or fund might be better for commodities traders and investors, like the Direxion Auspice Broad Commodity Strategy ETF (COM).

WHILE COMMODITIES ARE PERFORMING WELL IN 2021, INDIVIDUAL SECTORS ARE MIXED

Source: Bloomberg Finance, L.P., as of September 30, 2021. Past performance is not indicate of future results. You cannot invest directly in an index.

COMMODITY STRATEGY (COM) ETF: THE LONG AND NOT-SO-SHORT OF COMMODITIES INVESTING

Simply, owning commodities makes sense conceptually, but can be difficult to stomach considering how distinct individual performances can be. A more adaptive approach may be better suited for portfolio implementation. The Direxion Auspice Broad Commodity Strategy ETF (COM) seeks to provide investors with an opportunity to take advantage of rising commodity prices, while mitigating risk by going to cash when individual commodities are experiencing downward trends. In addition, the ETF seeks to provide commodity investment returns with potentially lower risk characteristics than traditional, long-only commodity strategies.

Exchange-traded commodity futures contracts generally are volatile and are not suitable for all investors.

Definitions

1The Consumer Price Index (CPI) measures the average change in prices over time that consumers pay for a basket of goods and services.

Citi US Surprise Economic Index: Measures the degree to which economic data is either beating or missing expectations.

Citi US Surprise Inflation Index: Measures whether agents are more optimistic or pessimist about the real economy than indicated by actual data releases. A positive (negative) reading of the surprise index suggests that economic releases have on balance been higher (lower) than consensus, meaning that agents were more pessimistic (optimistic) about the economy.

Bloomberg Commodity Index: Bloomberg Commodity Indices (BCOM) are a family of financial benchmarks designed to provide liquid and diversified exposure to physical commodities via futures contracts.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

CUSIP Identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by Standard and Poor’s Financial Services, LLC, and are not for use or dissemination in any manner that would serve as a substitute for a CUSIP service. The CUSIP Database, ©2011 American Bankers Association. “CUSIP” is a registered trademark of the American Bankers Association. Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Shares Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with concentration that results from the Fund’s investments in a particular industry, sector, or geographic region which can result in increased volatility. The Fund’s use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of the Fund include risks related to investment in commodity-linked derivatives and commodities, Futures Strategy Risk, Leverage Risk, Market Risk, Natural Disaster/Epidemic and Market Disruption Risk, Counterparty Risk, Cash Transaction Risk, Subsidiary Investment Risk, Interest Rate Risk, and Tax Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund. Exchange-traded commodity futures contracts generally are volatile and are not suitable for all investors.

The value of a commodity-linked derivative investment typically is based upon the price movements of a physical commodity and may be affected by changes in overall market movements, volatility of the index, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, embargoes, tariffs and international economic, political and regulatory developments. Commodity-linked derivatives also may be subject to credit and interest rate risks that in general affect the value of debt securities. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other investments. Risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of the instruments held by the Fund and the price of the futures contract; (b) possible lack of a liquid secondary market for a futures contract and the resulting inability to close a futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Adviser’s inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the Fund has insufficient cash, it may have to sell securities or financial instruments from its portfolio to meet daily variation margin requirements, which may lead to the Fund selling securities or financial instruments at a time when it may be disadvantageous to do so.

Distributor: Foreside Fund Services, LLC.