Source: Bloomberg Finance, L.P., as of January 31, 2021. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For standardized and month-end click here.

Ferris BuellerLife moves pretty fast. If you don't stop and look around once in a while, you could miss it."

Life Moves Pretty Fast. So Does Remote Work Momentum.

Collectively, investors under appreciate how swiftly humans can adapt to different circumstances. One of the reasons is… life can move pretty fast. Days blend into weeks, and weeks into months. In the midst of a global pandemic, lots of change was accelerated with long-term structural changes occurring under our noses. One of the most prominent adaptions was the successful adoption of remote work by a wide range of companies, including those that believed productivity was measured by time in a physical location, as opposed to actual output.

Still Value to Be Had

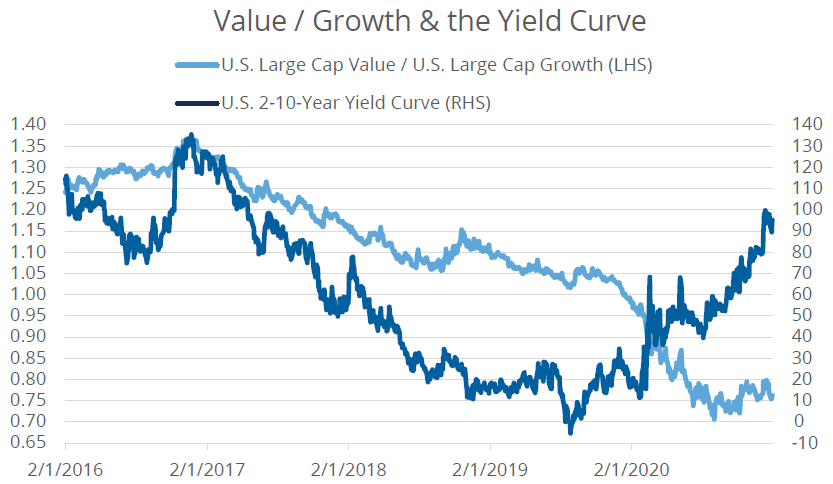

Since the strictest lockdowns lifted, economic recovery has been noticeable, albeit with further bifurcation between the haves and have-nots, whether in the economy or the markets. The pandemic, in many ways, simply lifted the veil of existing inequalities. In the stock market, the haves are growth companies, primarily in the technology sector. The have nots, however, are value companies in sectors such as financials and energy. Historically, in times of economic recovery when bond yields are increasing and the yield curve is steepening, value as a style does well. Not to say that this time, it is different, but since the COVID crash, value has only recovered modestly. With President Biden in office, along with Democrat control of Congress, value stocks may have support in addition to the economic recovery, but time will tell.

Value has Bounced, but Modestly

The lack of a robust recovery for value tells us the market is not quite convinced of the path of this recovery, especially the narrative for pent up demand. Even so, one of the more typical responses we hear from investors regarding work from home stocks is that it has simply been a trade, and its best days are behind it. We believe this view is misguided on multiple fronts.

Seven Years to Herd Immunity

Unfortunately, the virus continues to outpace science. On one hand, it is encouraging to see vaccinations outnumber new cases. On the other hand, recent mutations make the need for rapid vaccine deployment even greater. According to the Bloomberg Vaccine Tracker, the US will not reach the 75% to 85% coverage, suggested by experts to see a return to normal, until the end of 2021. At the current pace, it will take seven years for the entire world to reach that number. With this being the case, it is hard to see a widespread resurgence of firms forcing employees to work entirely in the office, especially when productivity can be just as high outside of it.

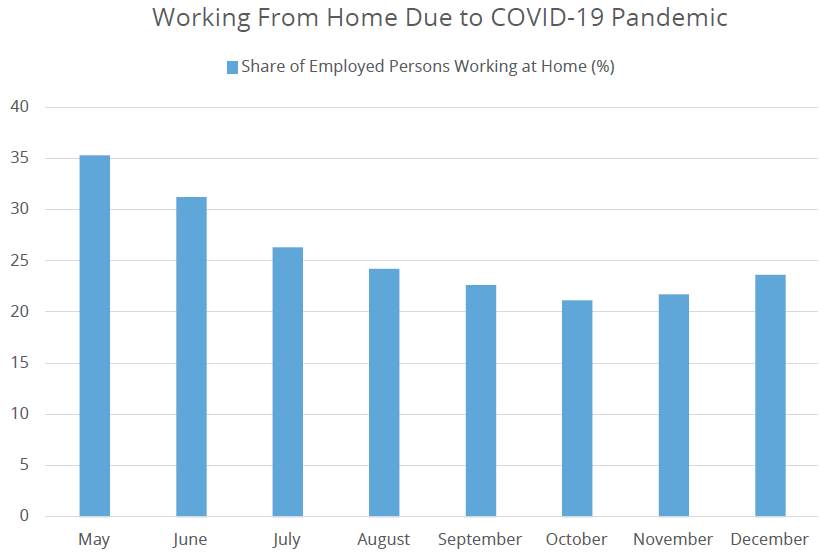

As time goes on, more and more companies continue to embrace remote work or hybrid working models. The most recent data from the U.S. Bureau of Labor Statistics makes this clear, as the percentage of Americans working from home has increased over the last two months, jumping 9% to 23.7%. So, while the number remains lower than May, it is not showing signs of slowing, and is now increasing.

Remote Work Momentum is Strong

Source: U.S. Bureau of Labor Statistics, as of December 31, 2020.

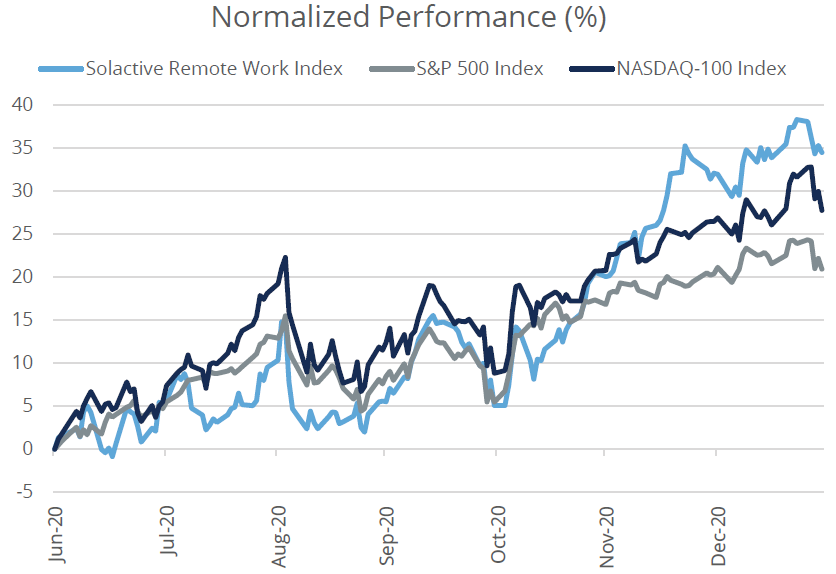

Businesses are adapting just as quickly as we, as people, have. From their perspective, this is both about providing the tools and applications for employees to work from anywhere, and about making their own enterprises more digital. And at the same time, work from home related stocks continue to outperform. In other words, the market continues to appreciate how quickly change is happening, and the secular nature of the change. The Solactive Remote Work Index has notably outperformed the S&P 500 Index and the NASDAQ 100 Index since the start of July, well after the initial market bounce.

Remote Work Stocks Continue to Outperform

Source: Bloomberg Finance, L.P., as of January 31, 2021. You cannot invest directly in an index.

Investors should not be overly negative on the economic recovery, but should not lose sight of the disruption happening before their eyes. In the words of Ferris Bueller, “Life moves pretty fast. If you don't stop and look around once in a while, you could miss it.” In today’s market environment, it means to take advantage of mega trends such as the increased adoption of remote work, which continues to outperform even as the light at the end of the COVID-tunnel gets brighter.

The Direxion Work From Home ETF (WFH) offers exposure to companies across four technology pillars, allowing investors to gain exposure to those companies that stand to benefit from an increasingly flexible work environment. The fund’s index utilizes a proprietary algorithm to evaluate large volumes of publicly available information, such as annual reports, business descriptions and financial news to identify the 40 stocks accelerating greater adaption of remote work.

Invest in the Remote Revolution Now

Definitions:

Nasdaq-100® Index: The Index includes 100 of the largest domestic and international non-financial companies listed on the NASDAQ Stock Market® based on market capitalization. All companies listed on the index have an average daily trading volume of at least 200,000 shares. One cannot directly invest in an index.

Solactive Remote Work Index: The Index is comprised of U.S. listed securities and American Depository Receipts (“ADRs”) of companies that provide products and services in at least one of the following business segments that facilitate the ability of people to work from home: remote communications, cyber security, online project and document management, and cloud computing technologies (“WFH Industries”). The Index consists of 40 companies, namely, the top 10 ranked companies in each of the four WFH Industries. The Index is equal weighted at each semi-annual reconstitution and rebalance date. One cannot directly invest in an index.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-301-9214 or visit our website at direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Market Disruptions Resulting from COVID-19. The outbreak of COVID-19 has negatively affected the worldwide economy, individual countries, individual companies and the market in general. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to the Fund.

CUSIP Identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by Standard and Poor’s Financial Services, LLC, and are not for use or dissemination in any manner that would serve as a substitute for a CUSIP service. The CUSIP Database, ©2011 American Bankers Association. “CUSIP” is a registered trademark of the American Bankers Association.

Solactive AG is not a sponsor of, or in any way affiliated with, the Direxion Work From Home ETF.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Shares ETF Risks – Investing involves risk including possible loss of principal. There is no guarantee the investment strategy will be successful. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from competitors with lower production costs. ADRs are issued by non-U.S. companies and are subject to various foreign investment risks including but not limited to the risk that the currency in the issuing company’s country will drop relative to the U.S. dollar, that politics or regime changes in the issuing company’s country will undermine exchange rates or destabilize the company and its earnings. Additional risks of the Fund include, but are not limited to, Index Correlation/Tracking Risk, Index Strategy Risk, Market Disruption Risk, American Depositary Receipts Risk and risks associated with the market capitalizations of the securities in which the Fund may invest. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Distributor: Foreside Fund Services, LLC.