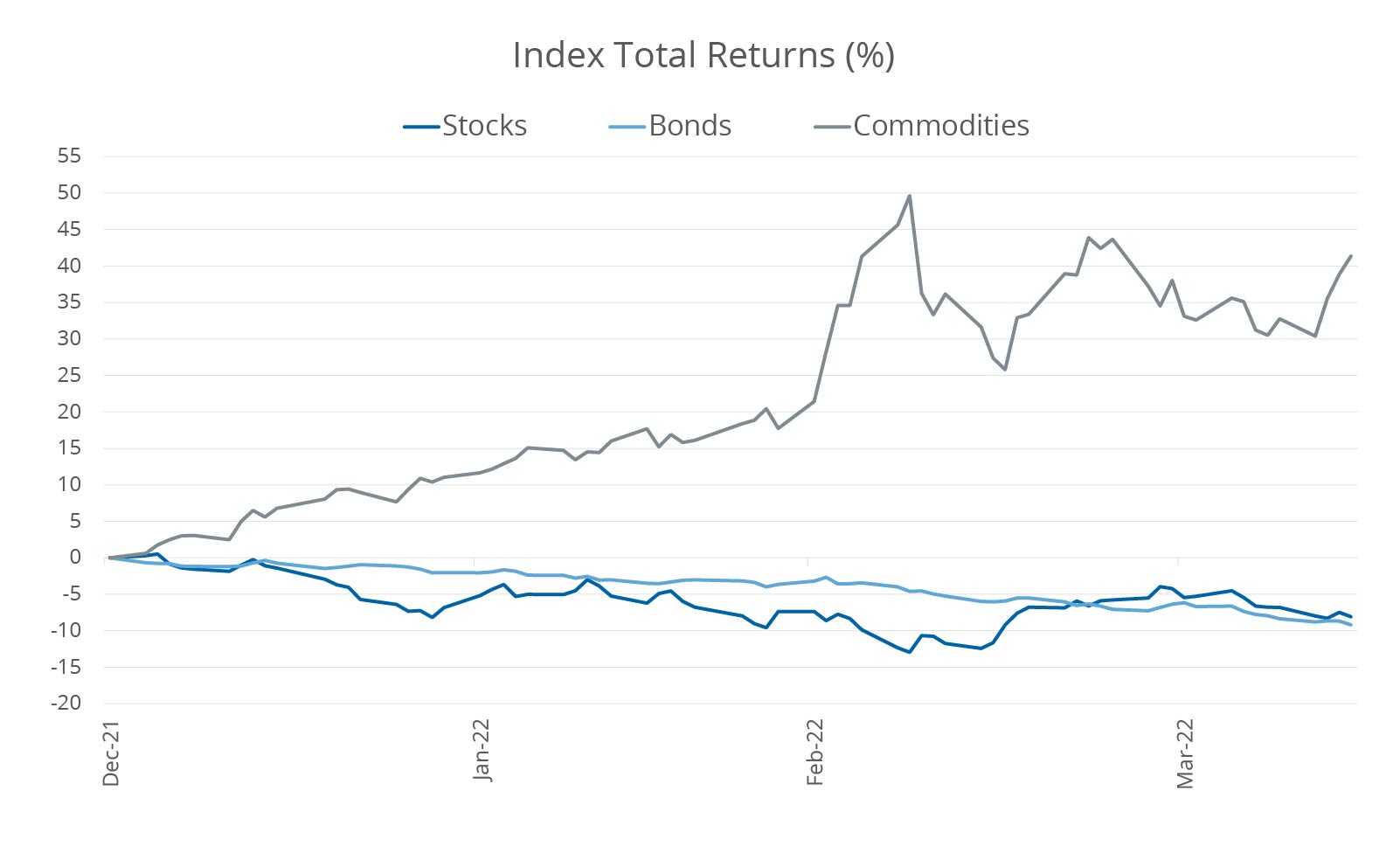

After a rocky start for financial markets in January, everything from stocks to bonds to crypto are struggling to find their footing in 2022. The outlook for these assets remains murkier than ever thanks to heightened geopolitical risks, economic growth slowing, and inflation staying well above central bank targets, making it even harder for investors to make decisions. In fact, a standard 60/40 portfolio of stocks and bonds has had one of its worst starts to a calendar year ever! A big culprit is that bonds, especially longer-dated ones, are not providing the ballast many expected them to do. However, one asset class – commodities - proved to be a standout this year.

Commodities are Crushing It

Source: Bloomberg Finance, L.P., as of April 14, 2022. Stocks represents the MSCI ACWI IMI. Bonds represents the Bloomberg Global Aggregate Index. Commodities represents the S&P GSCI Index.*

Past performance does not guarantee future results. You cannot invest directly in an index.

Why are commodities the lone bright spot, especially after years of underperformance and neglect by investors?

Inflation!

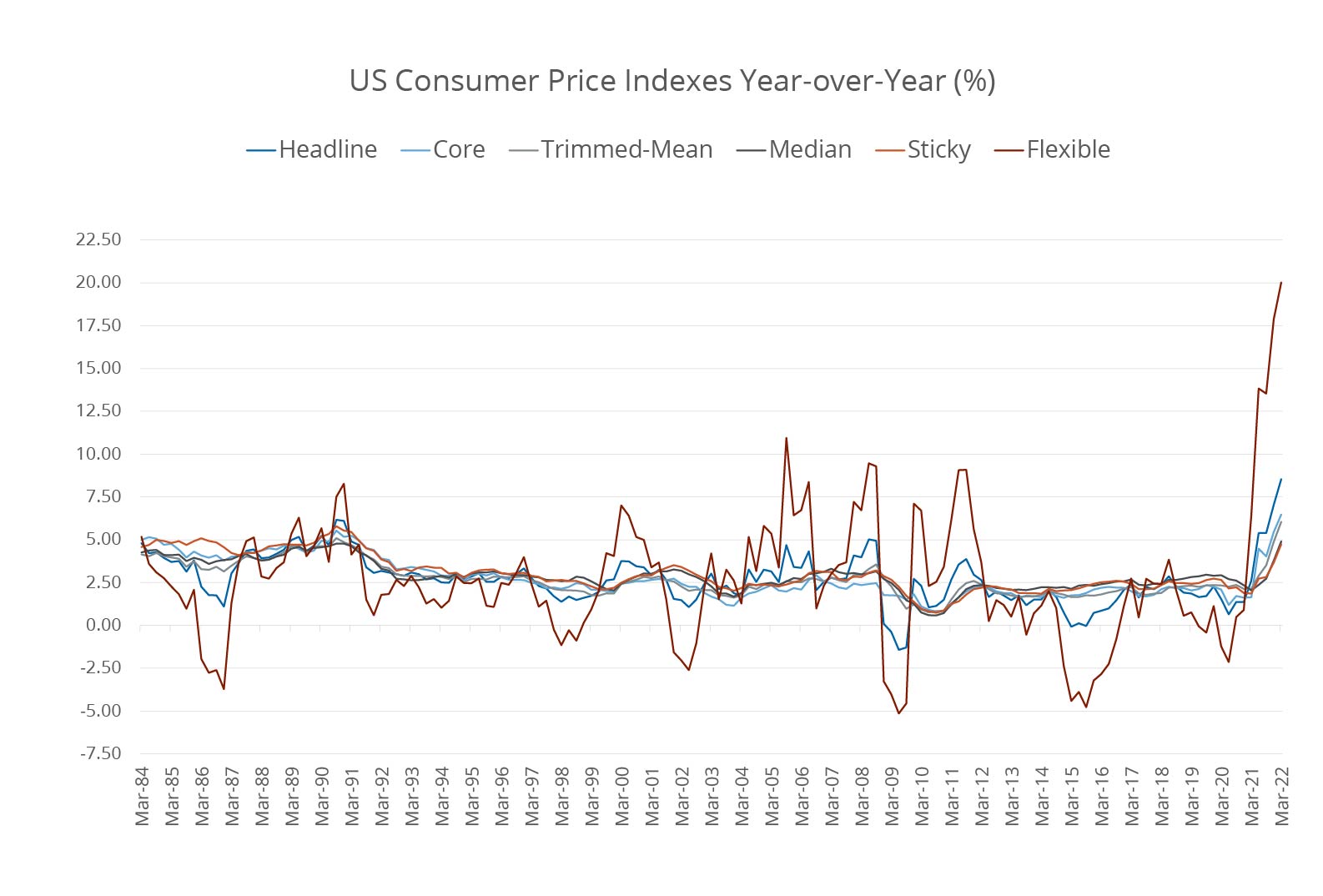

With a 1.4% increase in March, the US Producer Price Index (PPI) recorded the highest ever year-over-year increase in history. The well-followed US Consumer Price Index (CPI)* saw its highest year-over-year increase in 40 years. Together, these highlight the serious threat rising prices have on investment portfolios. The below figure shows various measures of CPI including core, trimmed-mean, median, sticky, and flexible. While not pictured, a breakdown by goods and services are both increasing as well. Although these metrics have pros and cons as tools to understand price trends, they all tell the same story: prices are rising and rising fast.

With inflation this high, investors lose money by sitting in cash. However, risks are considerably higher than previous years, so allocating capital is more challenging.

US Inflation Prints are off the Charts

Source: Bloomberg Finance, L.P., as of March 31, 2022. Headline represents the Bureau of Labor Statistics Consumer Price Index. Core represents the Bureau of Labor Statistics Core Consumer Price Index, which measures CPI excluding food and energy components. Trimmed-Mean represents the Federal Reserve Bank of Cleveland’s 16% Trimmed-Mean Consumer Price Index, which excludes the 8% of CPI components with highest and lowest one month price changes. Median represents the Federal Reserve Bank of Cleveland’s Median Consumer Price Index, which measures the median price change of the CPI components. Sticky represents the Federal Reserve Bank of Atlanta Sticky-Price, which measures the CPI components that are slow to change. Flexible represents the Federal Reserve Bank of Atlanta Flexible-Price, which measures the CPI components that are quick to change.

These jumps in prices are something a generation of investors, or perhaps even two, have never faced. While a case can be made inflation has peaked, the sheer magnitude of these increases is staggering. Investors may no longer be able to rely on stocks and bonds alone.

Not All Commodities─or Strategies─are Created Equal

Investors have historically looked to commodities to help navigate inflationary environments. The challenge with commodities is they are not a homogeneous asset class like stocks or corporate bonds. As stated before, most would not confuse an ear of corn with a gold bar; accordingly, investors should not expect their returns to behave similarly as their drivers of supply and demand are markedly different.

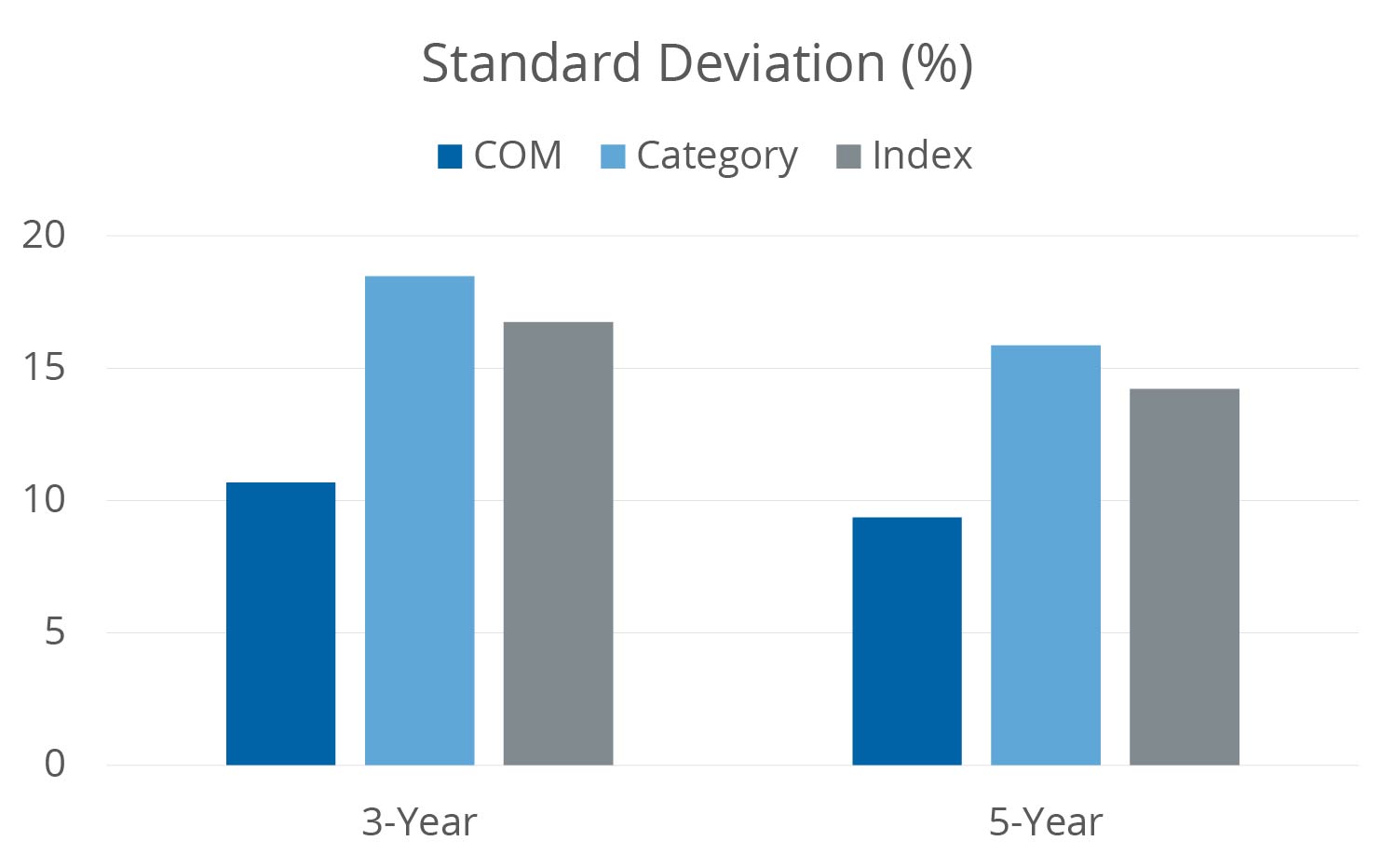

In this environment, most portfolios may benefit from an allocation to commodities, but a more adaptive approach could be suited to this environment considering the geopolitical risks and supply chain issues. Unlike most funds which provide static allocations to all commodities, the Direxion Auspice Broad Commodity Strategy ETF (COM) has the ability to shift the exposure to commodities intra-month, based on market conditions, thanks to its long/flat strategy (if a short signal is triggered, the position is moved to cash). This strategy may also offer more stable total returns due to its minimizing downside risks. If inflation has peaked, or even if deflationary pressures arise, the downside risk management could benefit allocations.

COM has Delivered Considerably Lower Volatility than its Peers

Source: Bloomberg Finance, L.P., as of Mar 31, 2022. COM represents the Direxion Auspice Broad Commodity Strategy ETF. Category represents the Morningstar Commodities Broad Basket. Index represents the Bloomberg Commodity Index.

To find out more about the Direxion Auspice Broad Commodity Strategy ETF (COM), click here.

*Definitions

- Standard Deviation is a measure of the dispersion of a set of data from its mean.

- The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

- The MSCI ACWI Investable Market Index (IMI) captures large, mid and small cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries

- The Bloomberg Global Aggregate Bond Index represents a close estimation of the performance that can be achieved by hedging the currency exposure of its parent index,the Bloomberg Global Aggregate Bond Index, a broad-based fixed-income index used by investors, to USD.

- The S&P GSCI Commodities Index serves as a benchmark for investment in the commodity markets and as a measure of commodity performance over time

Exchange-traded commodity futures contracts generally are volatile and are not suitable for all investors.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-301-9214 or visit our website at direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Direxion Shares Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with concentration that results from the Fund’s investments in a particular industry, sector, or geographic region which can result in increased volatility. The Fund’s use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of the Fund include risks related to investment in commodity-linked derivatives and commodities, Futures Strategy Risk, Leverage Risk, Market Risk, Natural Disaster/Epidemic and Market Disruption Risk, Counterparty Risk, Cash Transaction Risk, Subsidiary Investment Risk, Interest Rate Risk, and Tax Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund. Exchange-traded commodity futures contracts generally are volatile and are not suitable for all investors.

The value of a commodity-linked derivative investment typically is based upon the price movements of a physical commodity and may be affected by changes in overall market movements, volatility of the index, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, embargoes, tariffs and international economic, political and regulatory developments. Commodity-linked derivatives also may be subject to credit and interest rate risks that in general affect the value of debt securities. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other investments. Risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of the instruments held by the Fund and the price of the futures contract; (b) possible lack of a liquid secondary market for a futures contract and the resulting inability to close a futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Adviser’s inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the Fund has insufficient cash, it may have to sell securities or financial instruments from its portfolio to meet daily variation margin requirements, which may lead to the Fund selling securities or financial instruments at a time when it may be disadvantageous to do so.