Unveiling Opportunities: Commodities in Today’s Market Landscape

When investors start to worry about inflation*, they often gravitate towards commodities as a hedge against inflationary pressures. So, it’s no surprise that everything from metals to energy saw a burst of buying in the last few years. Pandemic-related stimulus and supply-chain issues contributed to a huge pop in inflation, as any consumer can attest. Crude oil, for example, plunged early in 2020 but then staged a dramatic rebound, hitting over $100/barrel in 2022 (helped along by Russia’s invasion of Ukraine).

But, in recent months, many commodities have sold off, with some investors convinced that disinflation is here to stay. Cooling inflation has also put the Federal Reserve on pause from further rate hikes. Despite positive indicators that inflation is coming down, it may be quite some time before it returns to the Fed’s 2% target. Could it be a good time for contrarian investors to add commodities to their portfolio at reasonable prices?

Understanding Commodities Markets Dynamics

Investors have several ways to get exposure to commodities, including buying commodity resource equities, using futures-based commodity exchange-traded funds (ETF), or purchasing an exchange-traded note (ETN) linked to commodity futures. The potential advantage of going the futures route is one can obtain diversified exposure to the actual physical commodity complex instead of using either natural resource equities or an ETN structure where there could be issuer risk. For instance, the Auspice Broad Commodity Index* may invest in 12 different commodities broken down into three sub-groups: energy, metals, and agricultural.

Commodity prices are affected by several factors such as the economic outlook, consumer confidence, the strength of the U.S. dollar, production levels, changes in reported inventories, and forecasts for central bank policy. Speculative money, from hedge funds and other players, can also have an impact on commodity prices.

Commodities as a Hedge?

Some investors allocate part of their portfolios to commodities as a long-term strategic holding for diversification and potential returns.

For one thing, a resurgence of inflation may lead to renewed strength in commodity prices, as was seen in the 1970s. Commodities may act as a portfolio diversifier, offering potentially uncorrelated returns to both stocks and bonds. In addition, commodities (like gold) tend to benefit from a weaker U.S. dollar. Finally, geopolitical tensions continue simmer around the globe, and any flare-ups could lead rising commodity prices. Recently, the current disruptions within the Red Sea, which is a major artery to transport many commodities including energy and grains, could have a lasting impact on supply chains.

Of course, investors should also be aware of factors that may lead to depressed commodity prices. For example, a stronger U.S. dollar tends to weigh on commodity prices. So too does slower growth in China and other emerging market economies.

A Futures-Based ETF for Commodities

Investors looking to add commodities to their portfolio can do so with the Direxion Auspice Broad Commodity Strategy ETF (Ticker: COM). This unleveraged ETF seeks investment results, before fees and expenses, that track the Auspice Broad Commodity Index. Please note that the COM ETF generates a 1099 for tax reporting purposes.

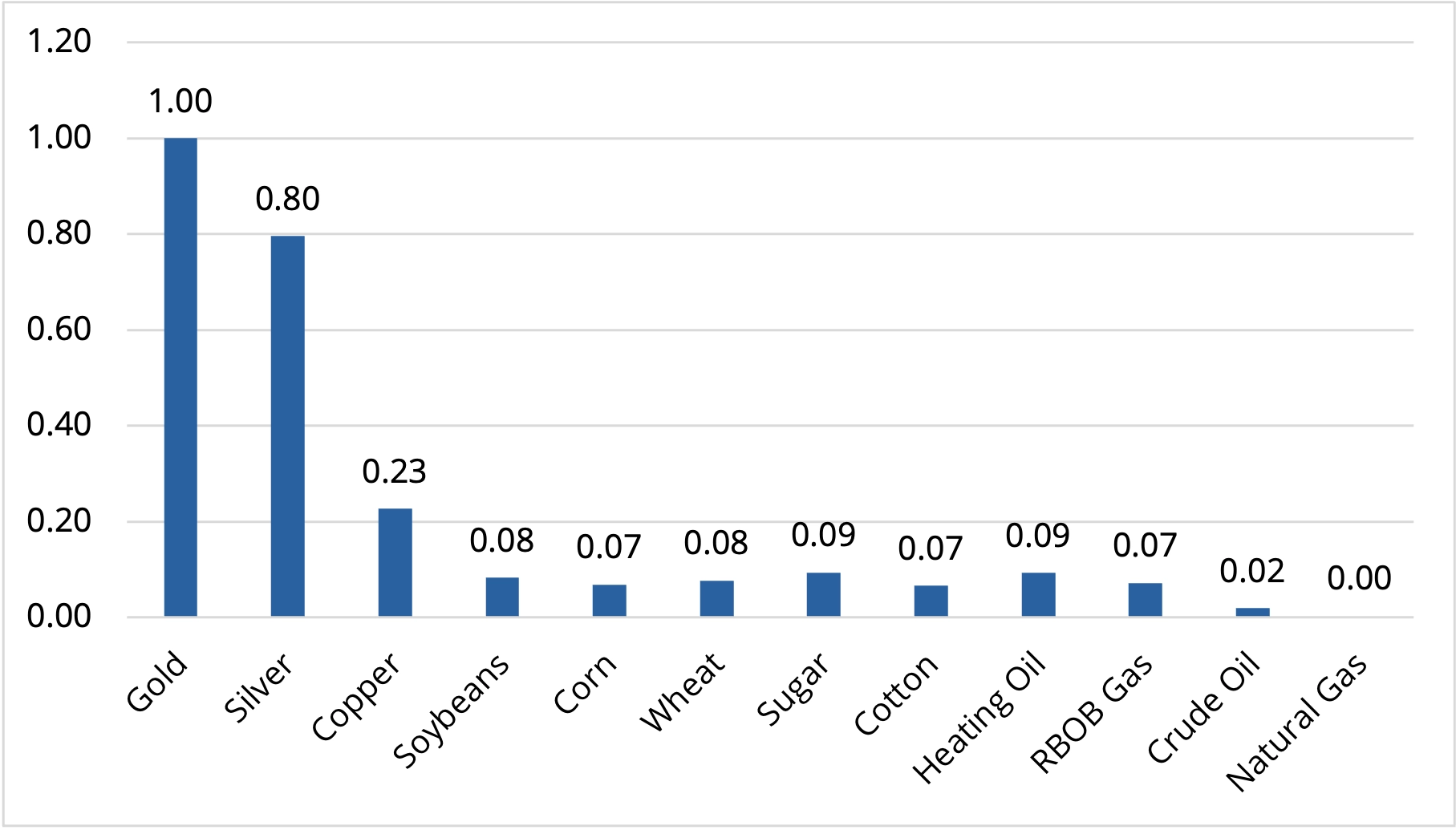

The Auspice Broad Commodity Index (ABCERI)* is a rules- based index which aims to take tactical long positions in commodity futures by focusing on price momentum. Crucially, the index does not have to always be fully invested, differentiating it from most notable broad commodity index peers. When an individual commodity shows price weakness, that position will be in Cash. The positioning can be very important because commodities don’t always move in tandem, and most commodities have a low correlation to each other as evident by the chart below showing Gold’s low correlation to most other commodities, excluding Silver.

Gold Shows Low Correlation to Most Other Commodities (January ’13 through November ’23)

Source: Bloomberg Finance, L.P., 12/31/2012 – 11/30/2023.

Through its tactical approach, the COM ETF does the heavy lifting for investors looking for broad commodity exposure. The strategy seeks to provide most of the commodity upside while mitigating the overall downside risk. The chart below illustrates the ABCERI index superior risk/return characteristics relative to broad commodity index peers.

ABCERI vs. Other Notable Commodity Benchmarks

| ABCERI | S&P GSCI* | BCOM* | DBC CI* | |

|---|---|---|---|---|

| (1) Annualized Return | 1.76% | -2.76% | -2.36% | 0.22% |

| (2) Annualized Standard Deviation | 8.84% | 21.57% | 14.64% | 17.54% |

| (3) Max Drawdown | -43.08% | -79.62% | -66.09% | -64.99% |

| (4) Correlation | 1.00 | 0.61 | 0.71 | 0.69 |

Source: Bloomberg Finance, L.P., 12/31/2012 – 11/30/2023.

Past performance is not indicative of future results. You cannot invest directly in an index. Index performance does not represent actual fund or portfolio performance. A fund or portfolio may differ significantly from the securities included in the index. Index performance assumes reinvestment of dividends but does not reflect any management fees, transaction costs, brokerage commissions on transactions. Such fees, expense and commissions would reduce returns.

(1) Annualized Return and past performance does not guarantee future results. Index returns and correlations are historical and are not representative of any Fund performance. Total returns of the Index include reinvested dividends. One cannot invest directly in an index. (2) Standard Deviation is a measure of the dispersion of a set of data from its mean. (3) Maximum Drawdown is the greatest percent decline from a previous high. (4) Correlation is a statistical measure of how two securities move in relation to each other.

*Definitions and Index Descriptions

*The Auspice Broad Commodity Index (ABCERI) is a rules-based long/flat broad commodity index that seeks to capture the majority of the commodity upside returns, while seeking to mitigate downside risk. The Index is made up of a diversified portfolio of 12 commodities futures contracts (Silver, Gold, Copper, Heating Oil, Natural Gas, Gasoline, Crude Oil, Wheat, Soybeans, Corn, Cotton, and Sugar) that based on price trends can individually be Long or Flat (in Cash). One cannot invest directly in an index.

*S&P GSCI Excess Return Index (S&P GSCI) is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities

*Deutsche Banc Liquid Commodity Optimum Yield Index (DBC CI) is an index composed of futures contracts on 14 of the most heavily-traded and important physical commodities in the world.

*Bloomberg Commodity Excess Return Index (BCOM) is a broadly diversified index that allows investors to track 19 commodity futures through a single, simple measure.

Investing involves risk including possible loss of principal.

An investor should carefully consider the Fund’s investment objective, risks, charges, and expenses before investing. The Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain the Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at direxion.com. The Fund’s prospectus and summary prospectus should be read carefully before investing.

Futures may be affected by backwardation or contango. Backwardation is a market condition in which a futures price is lower in the distant delivery month than in the near delivery month. Contango is a market condition in which the futures price is higher in the distant delivery month than in the near delivery month. In cases of contango, the Fund’s total return may be lower than might otherwise be the case because the Fund would be selling less expensive contracts and buying a more expensive ones.

Direxion Shares Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with concentration that results from the Fund’s investments in a particular industry, sector, or geographic region which can result in increased volatility. The Fund’s use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of the Fund include, but are not limited to, Index Correlation Risk, Index Strategy Risk, Derivatives Risk, Commodity-Linked Derivatives Risk, Futures Strategy Risk, Leverage Risk, Counterparty Risk, Cash Transaction Risk, Subsidiary Investment Risk, Interest Rate Risk, and Tax Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Exchange-traded commodity futures contracts generally are volatile and are not suitable for all investors. The value of a commodity-linked derivative investment typically is based upon the price movements of a physical commodity and may be affected by changes in overall market movements, volatility of the index, changes in interest rates, or factors affecting a particular industry or commodity, such as global pandemics, weather and other natural disasters, changes in supply and production, embargoes, tariffs and international economic, political and regulatory developments and changes in speculators’ and/or investors’ demand. Commodity-linked derivatives also may be subject to credit and interest rate risks that in general affect the value of debt securities. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other investments.

Risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of the instruments held by the Fund and the price of the futures contract; (b) possible lack of a liquid secondary market for a futures contract and the resulting inability to close a futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Index’s inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the Fund has insufficient cash, it may have to sell securities or financial instruments from its portfolio to meet daily variation margin requirements, which may lead to the Fund selling securities or financial instruments at a time when it may be disadvantageous to do so.

Distributor: Foreside Fund Services, LLC.