According to the U.S. Bureau of Labor Statistics (BLS), 5.7% of employees worked entirely from home as of the end of 2019. Of course, the COVID-19 pandemic caused an explosion in those doing so. While there is now a cottage industry of work from home trends at the employer and employee level, hard data has been difficult to find. Thanks to the BLS, that is no longer the case.

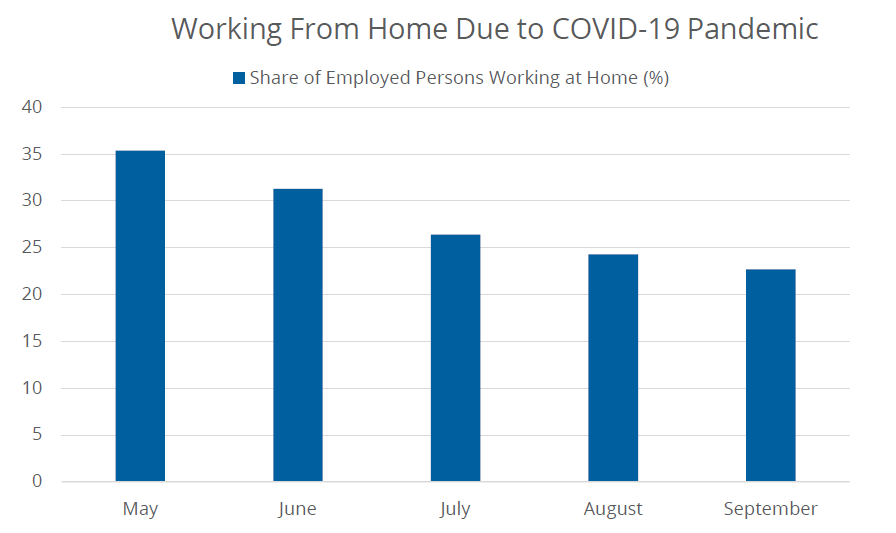

Due to the need for social distancing, the number of Americans working from home spiked to over 35% in May (the first month data became available). In September, 23% of Americans were still working at home. As illustrated below, while the total percentage has declined, the monthly rate of change has slowed sharply. This moderation offers an early sign of the long-term durability of this theme, as a growing number of firms realize the benefits to remote work outweigh the challenges. This data aligns with the blockbuster earnings releases from companies, such as Zoom Video Communications, Inc., which made it clear momentum for work from home technologies is growing, not slowing.

Hard Data Shows Returning to the Office has Moderated

Source: U.S. Bureau of Labor Statistics, as of September 2020.

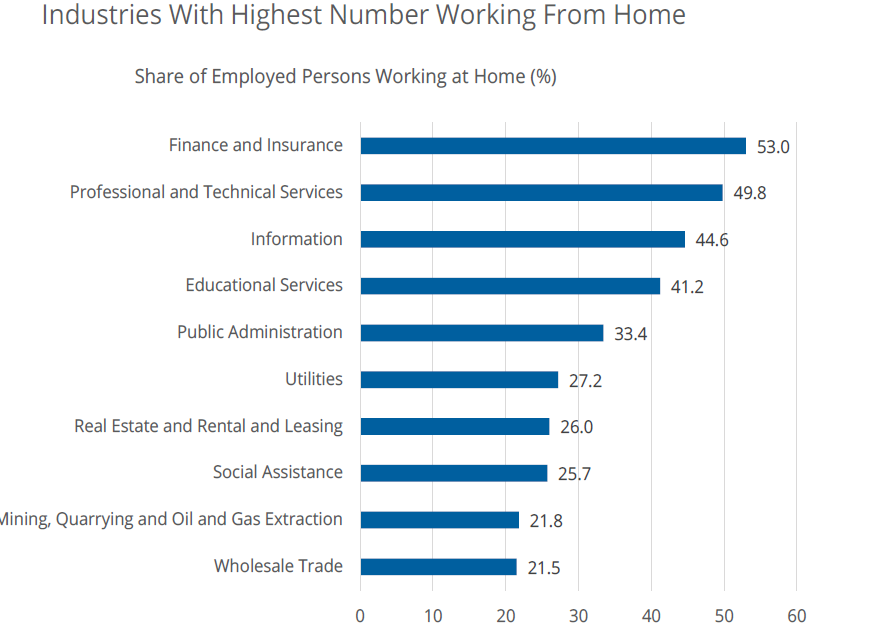

At the industry level, finance and insurance have the largest percentage of persons working at home, with 53% doing so. Professional and technical services (49.8%) and information (44.6%) sit in the number two and three spots. As one may expect, the industry with the smallest share doing so is private household services (3.5%), followed by agriculture and related industries (4.2%) and food services (4.8%).

Financial Services is Leading the WFH Charge

Source: U.S. Bureau of Labor Statistics, as of September 2020.

The latest PwC COVID-19 CFO Pulse Survey continues to show companies are gaining comfort with remote work as well. Now, 52% of CFOs say remote work will remain a permanent option for roles that allow for it. For context, the number was 47% in the April survey. While there will be an inventible limit to how much greater this can increase, there is likely room for it to continue moving higher in the near-term and the longer-term as remote and hybrid working models become more embedded and accepted.

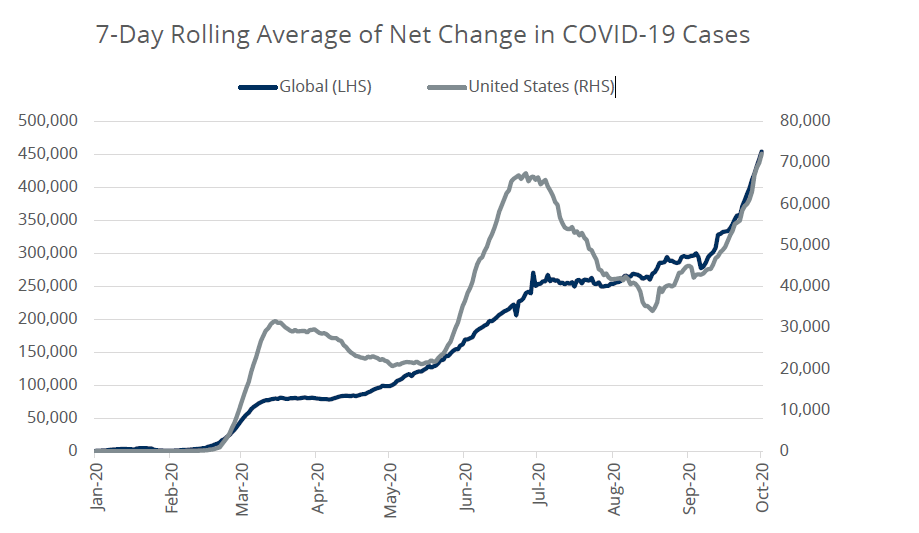

In addition to remote work driving benefits to productivity and bottom lines, the increase in case counts, particularly in the US, may dampen and continue to push out reopening plans for many companies. For example, a New York Times article published before the recent uptick in US cases noted July is the new January for many companies looking to return workers back to offices safely and effectively. At the same time, policymakers around the globe (Italy being the latest country) are also embracing working from home as an effective tool to help limit virus spread, while mitigating the impact of more draconic economic shutdowns.

COVID-19 Cases are ascending Sharply…Again

Source: Bloomberg Finance, L.P., as of October 27, 2020.

Of course, the medical community has made significant strides in understanding the virus and improving outcomes for patients, but the macro backdrop continues to be positive for companies powering the ability for firms to navigate having workers in disparate locations. The Direxion Work From Home ETF (Ticker: WFH) offers exposure to ten stocks in each of the four pillars of remote work – cloud technologies, cyber security, online project and document management, and remote communications – offering investors the opportunity to capitalize on a long-term trend continuing to gain momentum.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-301-9214 or visit our website at direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Market Disruptions Resulting from COVID-19. The outbreak of COVID-19 has negatively affected the worldwide economy, individual countries, individual companies and the market in general. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to the Fund.

CUSIP Identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by Standard and Poor’s Financial Services, LLC, and are not for use or dissemination in any manner that would serve as a substitute for a CUSIP service. The CUSIP Database, ©2011 American Bankers Association. “CUSIP” is a registered trademark of the American Bankers Association.

Solactive AG is not a sponsor of, or in any way affiliated with, the Direxion Work From Home ETF, or the Direxion Connected Consumer ETF

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Shares ETF Risks – Investing involves risk including possible loss of principal. There is no guarantee the investment strategy will be successful. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from competitors with lower production costs. ADRs are issued by non-U.S. companies and are subject to various foreign investment risks including but not limited to the risk that the currency in the issuing company’s country will drop relative to the U.S. dollar, that politics or regime changes in the issuing company’s country will undermine exchange rates or destabilize the company and its earnings. Additional risks of the Fund include, but are not limited to, Index Correlation/Tracking Risk, Index Strategy Risk, Market Disruption Risk, American Depositary Receipts Risk and risks associated with the market capitalizations of the securities in which the Fund may invest. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Distributor: Foreside Fund Services, LLC.