Regional Bank Stocks: Crisis Over or Eye of the Storm?

Editor's note: Any and all references to time frames longer than one trading day are for purposes of market context only, and not recommendations of any holding time frame. Daily rebalancing ETFs are not meant to be held unmonitored for long periods. If you don't have the resources, time or inclination to constantly monitor and manage your positions, leveraged and inverse ETFs are not for you.

Over the past few weeks, markets have grappled with a banking crisis that led to the collapse of three regional banks —Silicon Valley Bank, Signature Bank, and First Republic Bank. Federal regulators stepped in to mitigate the crisis, and we even saw JP Morgan acquire most of the assets of First Republic Bank. But the situation has been eerily quiet in the past couple weeks. Does that mean all is now well in the regional banking sector? Or are we just in the eye of the storm?

Mark-to-Market Disaster

The culprit behind the collapse in the regional banking sector ultimately boils down to risk management. These banks fulfilled various niche needs in the banking sector, whether it was providing financing to cryptocurrency projects or offering tech startups a place to park their cash with higher yields.

There was an influx in deposits during the early days of the Covid pandemic when interest rates were at all-time lows. Unfortunately, these banks failed to hedge their portfolios filled with asset-backed-securities. Then the Fed had to embark on its most aggressive monetary tightening campaign in history, which led to massive mark downs in the value of these banks’ assets. In short, things started to break, and these institutions became insolvent.

Is Confidence All That’s Lacking?

In light of this liquidity crisis, there was a massive outflow of deposits from regional banks into larger, better-capitalized ones. Rumors have circulated that the Federal Deposit Insurance Corporation (FDIC)* could increase deposit insurance, or even make an exception in the case of a broader fallout. Federal regulators have also insisted that the banking system remains strong, but naturally, these words should be taken with a grain of salt.

For years, it was widely accepted that higher interest rates could lead to bigger profits for banks due to spreads*. However, this only happens if the higher interest profits can offset the mark-to-market losses.

In the short-term, the regional banking situation boils down to monetary policy. The labor market remains strong, but inflation is showing signs of moderating per the recent April CPI* report. This could give the Fed cause to at least pause with the rate hikes. Traders will need to closely watch the next FOMC meeting that’s set to take place on June 14. Right now, expectations are for the Fed to not make any changes to short-term rates. This could give regional banks some additional time to sort out their affairs.

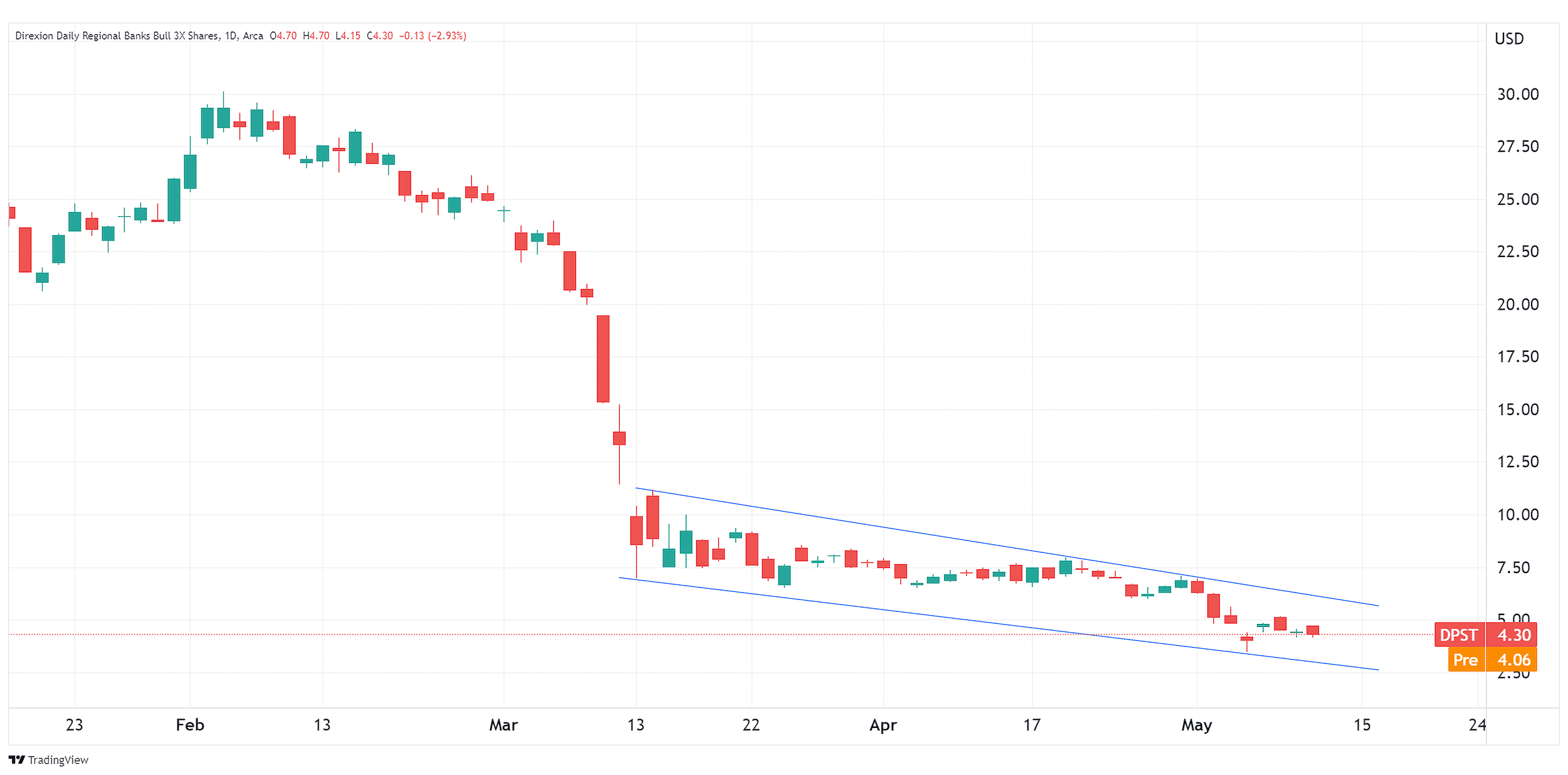

Traders seeking an aggressive contrarian play could find a short-term swing opportunity in Direxion’s Daily Regional Banks Bull 3X Shares (Ticker: DPST), which seeks daily investment results, before fees and expenses, of 300% of the performance of the S&P Regional Banks Select Industry Index*. There is no guarantee the fund will meet its stated investment objective.

Below is a daily chart of DPST as of May 11, 2023.

Source: TradingView.com

Candlestick charts display the high and low (the stick) and the open and close price (the body) of a security for a specific period. If the body is filled, it means the close was lower than the open. If the body is empty, it means the close was higher than the open.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For the most recent month-end performance go to Direxion.com/etfs. For standardized performance click here.

| INDEX TOP TEN HOLDINGS % AS OF 3/31/2023. SUBJECT TO CHANGE AND RISK. | |

|---|---|

| NY Comm Bancorp | 4.05 |

| Regions Financial | 3.02 |

| M&T Bank | 2.99 |

| First Horizon | 2.92 |

| Citizens Financial Group | 2.91 |

| Truist Financial | 2.90 |

| Huntington Bancshares | 2.76 |

| East West Bancorp | 2.64 |

| Zions | 2.45 |

| Cullen Frost Bankers | 2.36 |

Finessing the Financial Sector

Direxion also offers a way to trade large cap financials, both on the bull and bear side. Direxion’s Daily Financial Bull 3X Shares (Ticker: FAS) and Daily Financial Bear 3X Shares (Ticker: FAZ) seek daily investment results, before fees and expenses, of 300%, or 300% of the inverse (or opposite), of the performance of the Financial Select Sector Index*.

*Definitions & Index Descriptions

The S&P Regional Banks Select Industry Index (SPSIRBKT) is a modified equal-weighted index that is designed to measure performance of the stocks comprising the S&P Total Market Index that are classified in the Global Industry Classification Standard (GICS) regional banks sub-industry. One cannot directly invest in an Index.

The Financials Select Sector Index is provided by S&P Dow Jones and includes securities of companies from the following industries: Banks; Thrifts & Mortgage Finance; Diversified Financial Services; Consumer Finance; Capital Markets; Insurance; and Mortgage Real Estate Investment Trusts (REITs). One cannot directly invest in an index.

Each of the “S&P Regional Banks Select Industry Index” and the “Financials Select Sector Index” is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Rafferty Asset Management, LLC (“Rafferty”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Rafferty. Rafferty’s ETFs are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P Regional Banks Select Industry Index or the Financials Select Sector Index.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at www.direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Leveraged and Inverse ETFs pursue daily leveraged investment objectives which means they are riskier than alternatives which do not use leverage. They seek daily goals and should not be expected to track the underlying index over periods longer than one day. They are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk and who actively manage their investments.

Direxion Shares Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and include risks associated with the Fund concentrating its investments in a particular industry, sector, or geography which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Counterparty Risk, Rebalancing Risk, Intra-Day Investment Risk, Daily Index Correlation Risk, Other Investment Companies (including ETFs) Risk, Cash Transaction Risk, Tax Risk and risks specific to the securities of the Banking Industry and Financials Sector. Companies within the banking industry can be significantly affected by extensive governmental regulation, which may limit both the amounts and types of loans and other financial commitments they can make and the interest rates and fees they can charge and amount of capital they must maintain.

Performance of companies in the financials sector may be materially impacted by many factors, including but not limited to, government regulations, economic conditions, credit rating downgrades, changes in interest rates and decreased liquidity in credit markets. Additional risks include, for the Direxion Daily Financial Bull 3X Shares, Daily Index Correlation Risk, and for the Direxion Daily Financial Bear 3X Shares, Daily Inverse Index Correlation Risk, and risks related to Shorting. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

Distributor: Foreside Fund Services, LLC.